Square Enix 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 Square Enix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

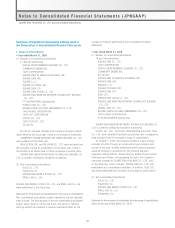

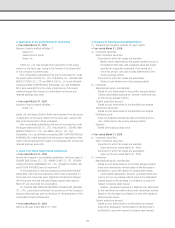

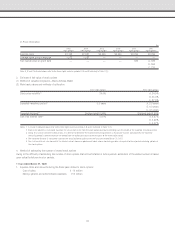

• Year ended March 31, 2009

Goodwill is amortized using the straight-line method over a period of

20 years. However, goodwill whose value has been extinguished is

fully amortized during the fiscal year in which it was incurred.

7. Scope of Cash and Cash Equivalents in the Consolidated

Statements of Cash Flows

• Year ended March 31, 2008

Cash and cash equivalents in the consolidated statements of cash

flows are comprised of cash on hand, bank deposits which are able

to be withdrawn on demand and highly liquid short-term investments

with an original maturity of three months or less and with minor

risk of significant fluctuations in value.

• Year ended March 31, 2009

Same as the year ended March 31, 2008

New Accounting Standards

• Year ended March 31, 2008

Not applicable

• Year ended March 31, 2009

(Changes in Standards and Valuation Methods for Major Assets)

Inventories

Previously, ordinary inventories held for sale had principally stated

at cost determined by the identified cost method. However, effective

from the fiscal year ended March 31, 2009, accompanying the adop-

tion of the “Accounting Standard for Measurement of Inventories”

(Accounting Standards Board of Japan (ASBJ) Statement No. 9,

issued on July 5, 2006), inventories are primarily stated at cost,

based on the identified cost method (for the best value of inventory

stated on the balance sheet, by writing inventory down based on its

decrease in profitability). As a result, in the fiscal year ended March

31, 2009, on a consolidated basis, operating income decreased

¥685 million. There was no impact on recurring income, or income

before income taxes and minority interests. The effects of adopting

the new standard to the segment information are noted in the

applicable section.

(Practical Solution on Unification of Accounting Policies Applied

to Foreign Subsidiaries for Consolidated Financial Statements)

Effective from the fiscal year ended March 31, 2009, the Company

has adopted the “Practical Solution on Unification of Accounting

Policies Applied to Foreign Subsidiaries for Consolidated Financial

Statements” (ASBJ Practical Issues Task Force No.18, issued on

May 17, 2006) and made revisions required for consolidated

accounting. This change had an immaterial impact on operating

income, recurring income, and income before income taxes and

minority interests.

(Accounting Standard for Lease Transactions)

Finance lease transactions that do not transfer ownership had

previously been accounted for in a similar manner to the accounting

treatment for ordinary operating lease transactions. However,

effective from the fiscal year ended March 31, 2009, the Company

adopted the “Accounting Standard for Lease Transactions” (ASBJ

Statement No. 13, originally issued by the First Subcommittee of

the Business Accounting Council on June 17, 1993, and revised

on March 30, 2007) and the “Guidance on Accounting Standard for

Lease Transactions” (ASBJ Guidance No. 16, originally issued by

the Law and Regulation Committee of the Japanese Institute of

Certified Public Accountants (JICPA) on January 18, 1994, and

revised on March 30, 2007) to account for such transactions in a

manner similar to the accounting treatment for ordinary sale and

purchase transactions. Regarding methods for depreciation of

leased assets under finance lease that do not transfer of ownership,

depreciation is computed under the straight-line method over the

lease term with no residual value. There was no impact on operating

income, recurring income, or income before income taxes and

minority interests as a result of this change. For finance lease

transactions that do not transfer ownership, and that commenced

before the initial year of the adoption of new accounting standards,

the Company continues to account for in the same manner as

operating lease transactions.

Reclassifications

• Year ended March 31, 2008

Not applicable

• Year ended March 31, 2009

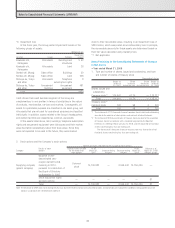

(Consolidated Balance Sheets)

Accompanying the application of the “Cabinet Office Ordinance

Partially Amending the Regulations on the Terminology, Format and

Preparation of Financial Statements” (Cabinet Office Ordinance No.

50, August 7, 2008), the item presented as “inventories” in the

fiscal year ended March 31, 2008 has been classified into

“merchandise and manufactured goods,” “work in progress,” and

“raw materials and supplies,” starting from the fiscal year ended

March 31, 2009. In the fiscal year ended March 31, 2008,

“merchandise” and “finished goods,” “work in progress,” and “raw

materials and supplies,” that were presented as “inventory,” were

¥2,629 million, ¥639 million, and ¥999 million, respectively.

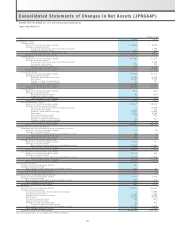

(Consolidated Statements of Changes in Net Assets)

Starting from the fiscal year ended March 31, 2009, to conform

with the introduction of extensible business reporting language

(XBRL) to EDINET (Electronic Disclosure for Investors’ NETwork),

which aims to improve the comparability of financial statements,

“change in scope of consolidation” combines two separate items

Notes to Consolidated Financial Statements (JPNGAAP)

32