SkyWest Airlines 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

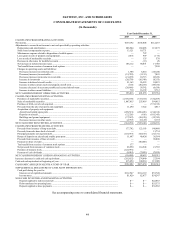

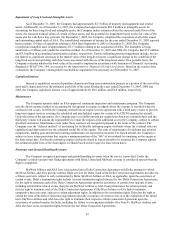

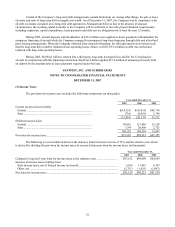

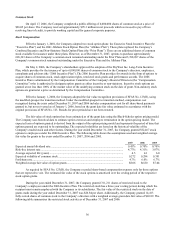

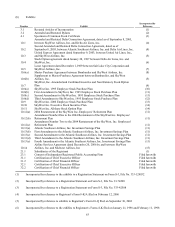

The significant components of the net deferred tax assets and liabilities are as follows (in thousands):

As of December 31,

2007 2006

Deferred tax assets:

Accrued benefits................................................................................ $20,134 $16,560

Net operating loss carryforward ........................................................ 25,738 55,332

AMT credit carryforward .................................................................. 24,511 2,266

Deferred aircraft credits..................................................................... 45,531 31,795

Accrued reserves and other................................................................ 7,739 9,779

Total deferred tax assets ....................................................................... 123,653 115,732

Deferred tax liabilities:

Accelerated depreciation ................................................................... (490,134) (355,103)

Maintenance and other....................................................................... (8,989) (29,879)

Total deferred tax liabilities.................................................................. (499,123) (384,982)

Net deferred tax liability....................................................................... $(375,470) $(269,250)

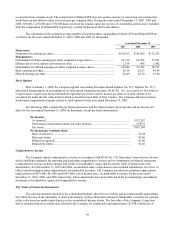

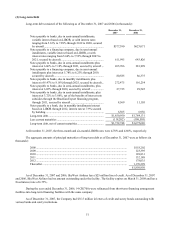

The Company’ s deferred tax liabilities were primarily generated through accelerated bonus depreciation on newly

purchased aircraft and support equipment in accordance with the Job Creation and Worker Assistance Act of 2002.

At December 31, 2007, the Company had federal net operating losses of approximately $34.6 million and state net

operating losses of approximately $350.2 million which will start to expire in 2024 and 2010 respectively. As of

December 31, 2007, the Company also had an alternative minimum tax credit of approximately $24.5 million which does not

expire.

FIN No. 48 prescribes a recognition threshold and measurement process for recording in the financial statements

uncertain tax positions taken or expected to be taken in a company’ s tax return. The provisions of FIN No. 48 became

effective for the Company beginning January 1, 2007. In conjunction with the year-end evaluation of the Company’ s FIN

No. 48 liability, the Company reduced its income tax provision by approximately $2.5 million for the year ended

December 31, 2007.

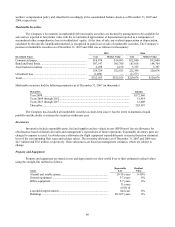

(4) Commitments and Contingencies

Lease Obligations

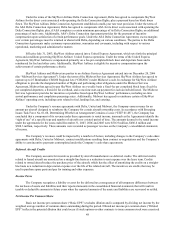

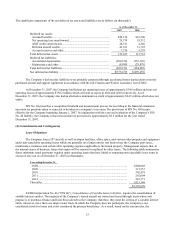

The Company leases 287 aircraft, as well as airport facilities, office space, and various other property and equipment

under non-cancelable operating leases which are generally on a long-term net rent basis where the Company pays taxes,

maintenance, insurance and certain other operating expenses applicable to the leased property. Management expects that, in

the normal course of business, leases that expire will be renewed or replaced by other leases. The following table summarizes

future minimum rental payments required under operating leases that have initial or remaining non-cancelable lease terms in

excess of one year as of December 31, 2007 (in thousands):

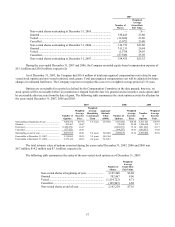

Year ending December 31,

2008 ........................................................................................................................... $304,948

2009 ........................................................................................................................... 315,357

2010 ........................................................................................................................... 302,479

2011 ........................................................................................................................... 292,604

2012 ........................................................................................................................... 293,171

Thereafter ..................................................................................................................... 1,821,140

$3,329,699

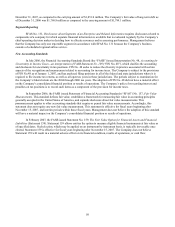

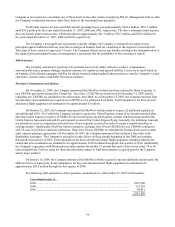

FASB Interpretation No. 46 (“FIN 46”), Consolidation of Variable Interest Entities, requires the consolidation of

variable interest entities. The majority of the Company’ s leased aircraft are owned and leased through trusts whose sole

purpose is to purchase, finance and lease these aircraft to the Company; therefore, they meet the criteria of a variable interest

entity. However, since these are single owner trusts in which the Company does not participate, the Company is not

considered at risk for losses and is not considered the primary beneficiary. As a result, based on the current rules, the