SkyWest Airlines 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

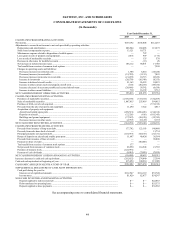

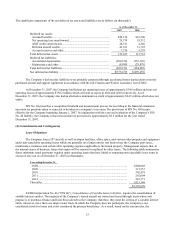

Certain of the Company’ s long-term debt arrangements contain limitations on, among other things, the sale or lease

of assets and ratio of long-term debt to tangible net worth. As of December 31, 2007, the Company was in compliance with

all debt covenants contained in its long-term debt agreements. Management believes that in the absence of unusual

circumstances, the working capital available to the Company will be sufficient to meet the present financial requirements,

including expansion, capital expenditures, lease payments and debt service obligations for at least the next 12 months.

During 2005, aircraft deposits with Bombardier of $22.0 million were applied as down payments to Bombardier for

temporary financing of aircraft while the Company arranged for permanent long-term financing through debt and other third

party leasing arrangements. When the Company obtained long-term debt financing, the debt agreements were written such

that the long-term debt could be refinanced into operating leases. Hence, in 2005, $55.4 million in debt was settled and

replaced with long-term operating leases.

During 2005, SkyWest Airlines entered into a third party long-term leveraged lease facility for 32 regional jet

aircraft. In conjunction with this financing transaction, SkyWest Airlines applied $37.0 million of amounts previously held

on deposit by the manufacturer as lease payments required under the lease.

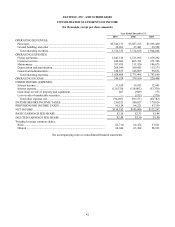

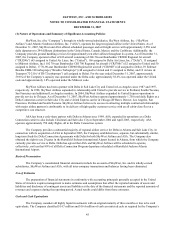

SKYWEST, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2007

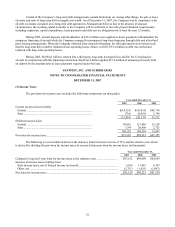

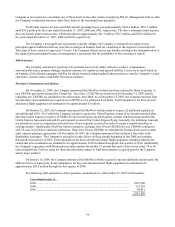

(3) Income Taxes

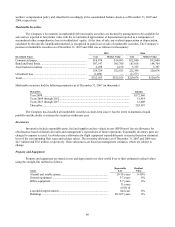

The provision for income taxes includes the following components (in thousands):

Year ended December 31,

2007 2006 2005

Current tax provision (benefit):

Federal ........................................................................................... $(14,355) $(41,914) $45,714

State ............................................................................................... (736) (8,419) 5,798

(15,091) (50,333) 51,512

Deferred tax provision:

Federal ........................................................................................... 99,026 123,646 13,124

State ............................................................................................... 7,194 20,908 2,723

106,220 144,554 15,847

Provision for income taxes ............................................................... $91,129 $94,221 $67,359

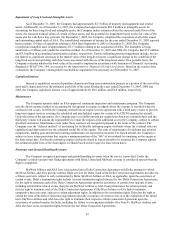

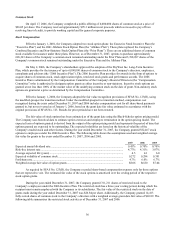

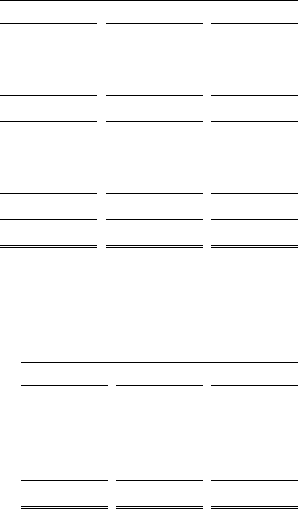

The following is a reconciliation between the statutory Federal income tax rate of 35% and the effective rate which

is derived by dividing the provision for income taxes by income before provision for income taxes (in thousands):

Year ended December 31,

2007 2006 2005

Computed “expected” provision for income taxes at the statutory rates .............................. $87,612 $84,009 $62,869

Increase in income taxes resulting from:

State income taxes, net of Federal income tax benefit....................................................... 6,268 11,867 6,387

Other, net ........................................................................................................................... (2,751) (1,655) (1,897)

Provision for income taxes ................................................................................................... $91,129 $94,221 $67,359