SkyWest Airlines 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

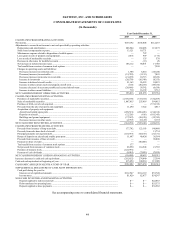

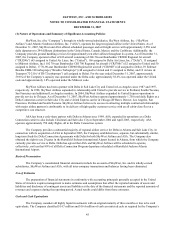

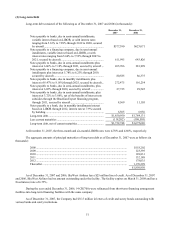

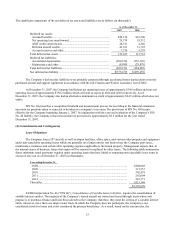

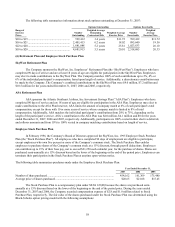

(2) Long-term Debt

Long-term debt consisted of the following as of December 31, 2007 and 2006 (in thousands):

December 31,

2007

December 31,

2006

Notes payable to banks, due in semi-annual installments,

variable interest based on LIBOR, or with interest rates

ranging from 5.16% to 7.89% through 2012 to 2020, secured

by aircraft................................................................................... $577,390 $623,071

Notes payable to a financing company, due in semi-annual

installments, variable interest based on LIBOR, or with

interest rates ranging from 5.60% to 7.52% through 2007 to

2021, secured by aircraft............................................................ 611,995 643,826

Notes payable to banks, due in semi-annual installments plus

interest at 6.06% to 7.18% through 2021, secured by aircraft ... 265,706 281,999

Notes payable to a financing company, due in semi-annual

installments plus interest at 5.78% to 6.23% through 2019,

secured by aircraft ..................................................................... 80,585 86,375

Notes payable to banks, due in monthly installments plus

interest of 6.47% to 8.18% through 2025, secured by aircraft... 272,475 101,254

Notes payable to banks, due in semi-annual installments, plus

interest at 6.05% through 2020, secured by aircraft .................. 27,725 29,545

Notes payable to banks, due in semi-annual installments, plus

interest at 3.72% to 3.86%, net of the benefits of interest rate

subsidies through the Brazilian Export financing program,

through 2011, secured by aircraft .............................................. 8,569 11,105

Notes payable to a bank, due in monthly installments interest

based on LIBOR through 2012, interest rate at 7.9% secured

by building................................................................................. 6,505 6,956

Long-term debt............................................................................. $1,850,950 $1,784,131

Less current maturities ................................................................. (118,202) (108,505)

Long-term debt, net of current maturities..................................... $1,732,748 $1,675,626

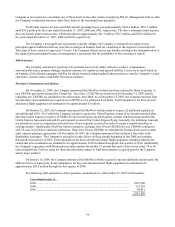

At December 31, 2007, the three-month and six-month LIBOR rates were 4.70% and 4.60%, respectively.

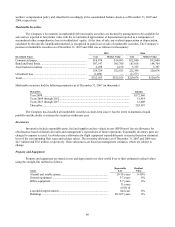

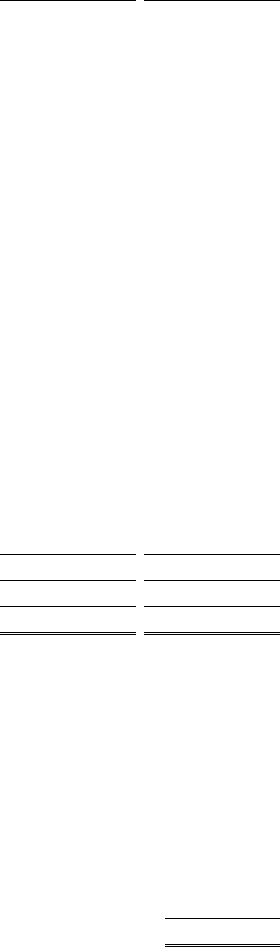

The aggregate amounts of principal maturities of long-term debt as of December 31, 2007 were as follows (in

thousands):

2008.............................................................................................................................. $118,202

2009.............................................................................................................................. 123,395

2010.............................................................................................................................. 128,831

2011.............................................................................................................................. 132,188

2012.............................................................................................................................. 178,035

Thereafter ..................................................................................................................... 1,170,299

$1,850,950

As of December 31, 2007 and 2006, SkyWest Airlines has a $25 million line of credit. As of December 31, 2007

and 2006, SkyWest Airlines had no amount outstanding under the facility. The facility expires on March 31, 2008 and has a

fixed interest rate of 6.75%.

During the year ended December 31, 2006, 14 CRJ700s were refinanced from short-term financing arrangement

facilities into long-term financing facilities with the same company.

As of December 31, 2007, the Company had $35.5 million in letters of credit and surety bonds outstanding with

various banks and surety institutions.