SkyWest Airlines 2007 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

of the weekly scheduled wire payments to SkyWest and ASA during December 2007. On February 1, 2008, SkyWest

Airlines and ASA filed a lawsuit in Georgia state court disputing Delta’ s treatment of the matter. The position Delta has

taken with respect to IROP expenses is inconsistent with the parties’ treatment of those expenses under the SkyWest Airlines

and ASA Delta Connection Agreements since their execution in September 2005. We have not recorded an allowance related

to the dispute in our consolidated financial statements. There can be no assurance that the dispute will be resolved consistent

with the position taken by SkyWest Airlines and ASA. If the dispute is not resolved consistent with the position taken by

SkyWest Airlines and ASA our financial results would be negatively impacted. The litigation may have other negative effects

on our relationship with Delta and our operations under the existing Delta Connection Agreements.

We have a significant amount of contractual obligations.

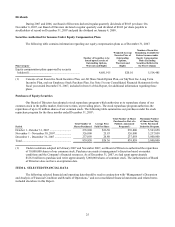

As of December 31, 2007, we had a total of approximately $1.9 billion in total long-term debt obligations.

Substantially all of this long-term debt was incurred in connection with the acquisition of aircraft, engines and related spare

parts including debt assumed in the ASA acquisition. We also have significant long-term lease obligations primarily relating

to our aircraft fleet. These leases are classified as operating leases and therefore are not reflected as liabilities in our

consolidated balance sheets. At December 31, 2007, we had 287 aircraft under lease, with remaining terms ranging from one

to 18 years. Future minimum lease payments due under all long-term operating leases were approximately $3.3 billion at

December 31, 2007. At a 7.39% discount factor, the present value of these lease obligations was equal to approximately

$2.1 billion at December 31, 2007. As of December 31, 2007, we had commitments of approximately $557.8 million to

purchase four CRJ900s, 18 CRJ700s, and four used CRJ200s and to sublease two CRJ700s. We expect to complete these

deliveries by the first quarter of 2010. Our high level of fixed obligations could impact our ability to obtain additional

financing to support additional expansion plans or divert cash flows from operations and expansion plans to service the fixed

obligations.

There are risks associated with our regional jet strategy, including potential oversupply and possible passenger

dissatisfaction.

Our selection of Bombardier Regional Jets as the primary aircraft for our existing operations and projected growth

involves risks, including the possibility that there may be an oversupply of regional jets available for sale in the foreseeable

future, due, in part, to the financial difficulties of regional and major airlines, including Delta, United, Northwest, Comair,

Mesa and ExpressJet. A large supply of regional jets may allow other carriers, or even new carriers, to acquire aircraft for

unusually low acquisition costs, allowing them to compete more effectively in the industry, which may ultimately harm our

operations and financial performance.

Our regional jet strategy also presents the risk that passengers may find the Bombardier Regional Jets to be less

attractive than other aircraft, including other regional jets. Recently, several other models of regional jets have been

introduced by manufacturers other than Bombardier. If passengers develop a preference for other regional jet models, our

results of operation and financial condition could be negatively impacted.

We may be limited from expanding our flying within the Delta and United flight systems, and there are constraints on

our ability to provide airline services to airlines other than Delta and United.

Additional growth opportunities within the Delta and United flight systems are limited by various factors. Except as

currently contemplated by our existing code-share agreements, we cannot assure that Delta or United will contract with us to

fly any additional aircraft. We may not receive additional growth opportunities, or may agree to modifications to our code-

share agreements that reduce certain benefits to us in order to obtain additional aircraft, or for other reasons. Furthermore, the

troubled financial condition, bankruptcies and restructurings of Delta and United may reduce the growth of regional flying

within their flight systems. Given the troubled nature of the airline industry, we believe that some of our competitors may be

more inclined to accept reduced margins and less favorable contract terms in order to secure new or additional code-share

operations. Even if we are offered growth opportunities by our major partners, those opportunities may involve economic

terms or financing commitments that are unacceptable to us. Any one or more of these factors may reduce or eliminate our

ability to expand our flight operations with our existing code-share partners. Additionally, even if Delta and/or United choose

to expand our fleet on terms acceptable to us, they may be allowed at any time to subsequently reduce the number of aircraft

covered by our code-share agreements. We also cannot assure you that we will be able to obtain the additional ground and

maintenance facilities, including gates, and support equipment, to expand our operations. The failure to obtain these facilities

and equipment would likely impede our efforts to implement our business strategy and could materially adversely affect our

operating results and our financial condition.