SkyWest Airlines 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

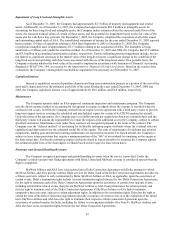

We currently intend to finance the acquisition of aircraft through manufacturer financing, third-party leases or long-

term borrowings. Changes in interest rates may impact our actual costs of acquiring these aircraft.

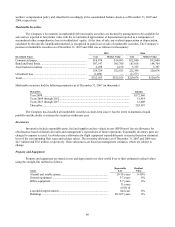

Auction Rate Securities Market Risk

The primary objective of our investment activities is to preserve principal while at the same time maximizing the

income we receive from our investments without significantly increasing risk. To achieve this objective, we maintain our

portfolio of cash equivalents and short-term and long-term investments in a variety of securities, including U.S. government

agencies, municipal notes which may have an auction reset feature, corporate notes and bonds, commercial paper, and money

market funds. These securities are classified as available for sale and consequently are recorded on the balance sheet at fair

value with unrealized gains or losses reported as a separate component of accumulated other comprehensive income (loss).

Our holdings of the securities of any one issuer, except government agencies, do not exceed 5% of the portfolio. As of

December 31, 2007, we held approximately $124 million of municipal notes with an auction reset feature. As of February 15,

2008 auctions failed for $19 million of our auction rate securities. An auction failure means that the parties wishing to sell

securities could not. If the issuers are unable to successfully close future auctions or their credit ratings deteriorate, we may in

the future be required to record an impairment charge on these investments. There is no assurance that currently successful

auctions on our remaining auction rate securities in our investment portfolio will continue to succeed and as a result our

ability to liquidate our investment and fully recover the carrying value of our investment in the near term may be limited or

not exist. We believe we will be able to liquidate our investment without significant loss within the next year. Based on our

expected operating cash flows, and our other sources of cash, we do not anticipate the potential lack of liquidity on these

investments will affect our ability to execute our current business plan.

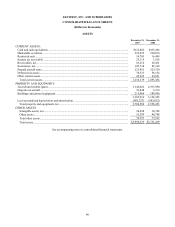

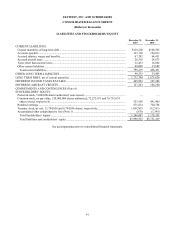

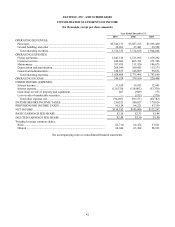

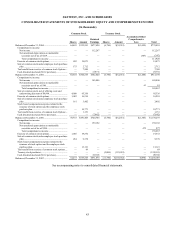

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information set forth below should be read together with the “Management’ s Discussion and Analysis of

Financial Condition and Results of Operations,” appearing elsewhere herein.