SkyWest Airlines 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

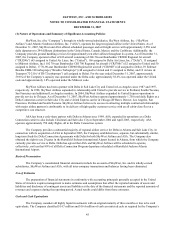

workers’ compensation policy and classified it accordingly in the consolidated balance sheets as of December 31, 2007 and

2006, respectively.

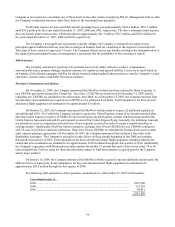

Marketable Securities

The Company’ s investments in marketable debt and equity securities are deemed by management to be available for

sale and are reported at fair market value with the net unrealized appreciation or depreciation reported as a component of

accumulated other comprehensive loss in stockholders’ equity. At the time of sale, any realized appreciation or depreciation,

calculated by the specific identification method, is recognized in gain (loss) on sale of marketable securities. The Company’ s

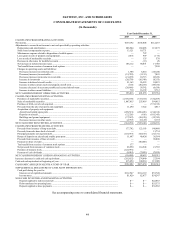

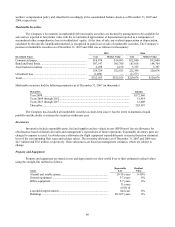

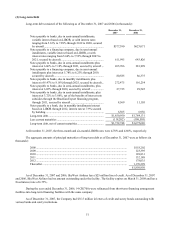

position in marketable securities as of December 31, 2007 and 2006 was as follows (in thousands):

2007 2006

Investment Types Cost Market Value Cost Market Value

Commercial paper..................................................................... $14,974 $14,983 $32,000 $32,000

Bond and bond funds................................................................ 507,147 505,706 187,016 184,769

Asset backed securities ............................................................. 2,208 2,236 3,333 3,307

524,329 522,925 222,349 220,076

Unrealized loss.......................................................................... (1,404) — (2,273) —

Total.......................................................................................... $522,925 $522,925 $220,076 $220,076

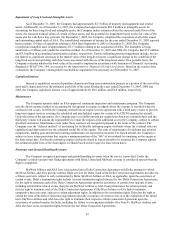

Marketable securities had the following maturities as of December 31, 2007 (in thousands):

Maturities Amount

Year 2008 ......................................................................................................................... $172,966

Years 2009 through 2012 ................................................................................................. 51,954

Years 2013 through 2017 ................................................................................................. 12,408

Thereafter ......................................................................................................................... 285,597

The Company has classified all marketable securities as short-term since it has the intent to maintain a liquid

portfolio and the ability to redeem the securities within one year.

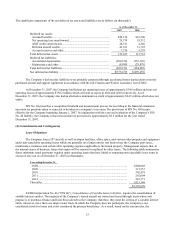

Inventories

Inventories include expendable parts, fuel and supplies and are valued at cost (FIFO basis) less an allowance for

obsolescence based on historical results and management’ s expectations of future operations. Expendable inventory parts are

charged to expense as used. An obsolescence allowance for flight equipment expendable parts is accrued based on estimated

lives of the corresponding fleet types and salvage values. The inventory allowance as of December 31, 2007 and 2006 was

$4.7 million and $3.6 million, respectively. These allowances are based on management estimates, which are subject to

change.

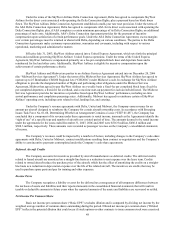

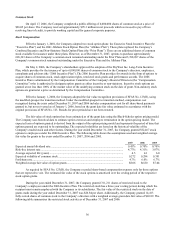

Property and Equipment

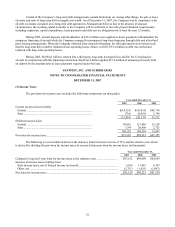

Property and equipment are stated at cost and depreciated over their useful lives to their estimated residual values

using the straight-line method as follows:

Assets

Depreciable

Life

Residual

Value

Aircraft and rotable spares.................................................................. 10-18 years 0-30%

Ground equipment.............................................................................. 5-7 years 0%

Office equipment................................................................................ 5-7 years 0%

Leasehold improvements....................................................................

15 years

or life of

the lease 0%

Buildings ............................................................................................ 20-39.5 years 0%