SkyWest Airlines 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

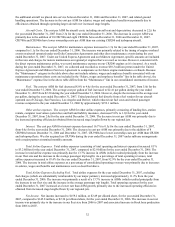

The cost per ASM for other expenses, primarily consisting of landing fees, station rentals, computer reservation

system fees and hull and liability insurance, decreased 4.8% to 2.0¢ for the year ended December 31, 2006, from 2.1¢ for the

year ended December 31, 2005. The primary reason for the decrease was the operating efficiencies obtained from increased

stage lengths flown by our regional jets.

Interest expense increased to approximately $118.0 million during the year ended December 31, 2006, from

approximately $53.3 million during the year ended December 31, 2005. The increase in interest expense was primarily due to

the acquisition of ASA’ s aircraft in September 2005 which are primarily financed with long-term debt.

Liquidity and Capital Resources

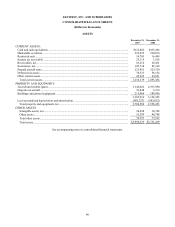

We had working capital of $811.9 million and a current ratio of 3.0:1 at December 31, 2007, compared to working

capital of $687.0 million and a current ratio of 2.7:1 at December 31, 2006. The increase was principally caused by cash

generated from operations during 2007. The principal sources of cash during the year ended December 31, 2007 were

$396.0 million provided by operating activities, $177.8 million of proceeds from the issuance of long-term debt, $29.0 from

the sale of common stock in connection with the exercise of stock options under our stock option and employee stock

purchase plans, $11.7 million from returns on aircraft deposits and $11.3 million from proceeds from the sale of property and

equipment. We invested $302.4 million in marketable securities, invested $298.5 million in flight equipment, made principal

payments on long-term debt of $111.0 million, repurchased $126.0 million of outstanding shares of our common stock,

invested $37.5 million in buildings and ground equipment, paid $8.1 million in cash dividends, invested $2.8 million in other

assets, and paid $32.3 million in deposits for aircraft. These factors resulted in a $292.7 million decrease in cash and cash

equivalents during the year ended December 31, 2007.

Our position in marketable securities, consisting primarily of bonds, bond funds and commercial paper, increased to

$522.9 million at December 31, 2007, compared to $220.1 million at December 31, 2006. The increase in marketable

securities was due primarily to cash generated from operations in 2007 that were invested in marketable securities.

At December 31, 2007, our total capital mix was 41.8% equity and 58.2% debt, compared to 41.3% equity and

58.7% debt at December 31, 2006.

As of December 31, 2007, SkyWest Airlines has a $25 million line of credit. As of December 31, 2007 and 2006,

SkyWest Airlines had no amount outstanding under the facility. The facility expires on March 31, 2008 and has a fixed

interest rate of 6.75%.

As of December 31, 2007, we had $35.5 million in letters of credit and surety bonds outstanding with various banks

and surety institutions.

As of December 31, 2007 and 2006, we classified $14.7 million and $16.4 million, respectively, as restricted cash,

related to our workers compensation policies.

Significant Commitments and Obligations

General

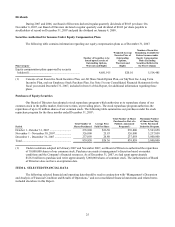

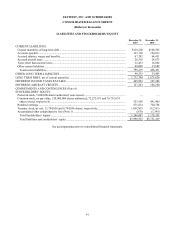

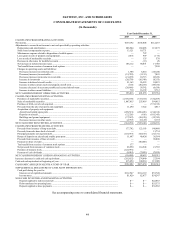

The following table summarizes our commitments and obligations as noted for each of the next five years and

thereafter (in thousands):

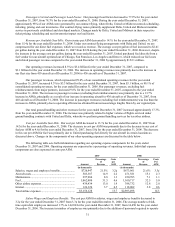

Total 2008 2009 2010 2011 2012 Thereafter

Firm aircraft commitments .......................... $557,830 $127,580 $332,239 $98,011 $— $— $—

Operating lease payments for aircraft and

facility obligations .................................... 3,329,699 304,948 315,357 302,479 292,604 293,171 1,821,140

Principal maturities on long-term debt ........ 1,850,950 118,202 123,395 128,831 132,188 178,035 1,170,299

Total commitments and obligations............. $5,738,479 $550,730 $770,991 $529,321 $424,792 $471,206 $2,991,439

Purchase Commitments and Options

On November 21, 2006, we announced that SkyWest Airlines had been selected by Delta to operate 12 new

CRJ700s previously operated by Comair Inc. Ten of the 12 CRJ700s were delivered by December 31, 2007 and the