SkyWest Airlines 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

We provide a substantial majority of regional airline service for Delta in Atlanta and Salt Lake City. In connection

with our acquisition of ASA in September 2005, we established new, separate, but substantially similar, long-term fixed-fee

Delta Connection Agreements with Delta for both SkyWest Airlines and ASA. We also obtained the right to use 29 gates in

the Hartsfield-Jackson International Airport located in Atlanta, from which we currently provide service to Delta. Delta has

also agreed that, starting in 2008, if Delta solicits requests for proposals to fly Delta Connection regional aircraft, ASA will

be permitted to bid to maintain the same percentage of total Delta Connection regional jet flights that it flies during 2007,

and, if ASA does not achieve the winning bid for the proposed flying, ASA will be permitted to match the terms of the

winning bid to the extent necessary for ASA to maintain its percentage of Delta Connection regional jet flying that it operated

during 2007.

Historically, multiple contractual relationships have enabled us to reduce reliance on any single major airline code

and to enhance and stabilize operating results through a mix of contract flying and our controlled or “pro-rate” flying. For the

year ended December 31, 2007, contract flying revenue and pro-rate revenue represented approximately 95% and 5%,

respectively, of our total passenger revenue. On contract routes, the major airline partner controls scheduling, ticketing,

pricing and seat inventories and we are compensated by the major airline partner at contracted rates based on the completed

block hours, flight departures and other operating measures. On pro-rate flights, we control scheduling, ticketing, pricing and

seat inventories and receive a pro-rated portion of passenger fares. As of December 31, 2007, essentially all of our Brasilia

turboprops flown for Delta were flown under pro-rate arrangements, while approximately 62% of our Brasilia turboprops

flown in the United system were flown under contractual arrangements, with the remaining 38% flown under pro-rate

arrangements.

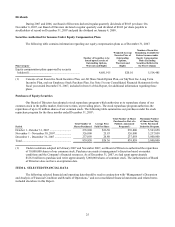

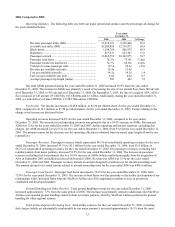

Financial Highlights

We had operating revenues of $3.4 billion for the year ended December 31, 2007, an 8.3% increase, compared to

$3.1 billion for the year ended December 31, 2006. We had net income of $159.2 million for the year ended December 31,

2007, an increase of 9.2%, or $2.49 per diluted share, compared to $145.8 million of net income or $2.30 per diluted share,

for the year ended December 31, 2006.

Total available seat miles (“ASMs”) for the year ended December 31, 2007 increased 13.7%, compared to the year

ended December 31, 2006, primarily as a result of an increase in our fleet size to 436 aircraft as of December 31, 2007, from

410 aircraft as of December 31, 2006. During the year ended December 31, 2007, we took delivery of eight new CRJ900s

and acquired 10 used CRJ700s and 11 used CRJ 200s from another operator. During the year ended December 31, 2007, we

generated 23.0 billion ASMs, compared to 20.2 billion ASMs during 2006.

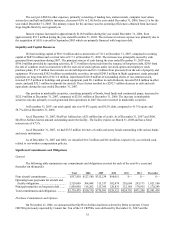

At December 31, 2007, we had approximately $660.4 million in cash and cash equivalents, restricted cash and

marketable securities, compared to approximately $651.9 million as of December 31, 2006. During the year ended

December 31, 2007, we spent approximately $126.0 million to purchase and retire approximately 5,000,000 shares of

common stock. Of the eight new CRJ900s we acquired during the year ended December 31, 2007, we financed seven aircraft

under long-term debt arrangements and one aircraft under a lease arrangement. The ten CRJ700s we acquired during the year

ended December 31, 2007 were acquired under sublease arrangements with a major partner at nominal monthly amounts. Of

the eleven used CRJ200s, we financed ten aircraft under lease arrangements and one was purchased with cash.

Outlook

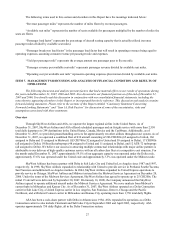

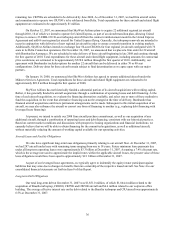

On October 12, 2007, we announced that SkyWest Airlines plans to acquire 22 additional regional jet aircraft

through 2010, 18 of which we intend to operate for United Express, as part of an aircraft transition plan, allowing United

Express to remove 23 EMB-120 30 seat turboprop aircraft from the contract reimbursement model in the United Express

Agreement and add 66 seat regional jet aircraft for United Express flying. Generally, the turboprop removals are intended to

occur in conjunction with deliveries of new regional jet aircraft in order to ensure a smooth transition in existing markets.

Additionally, SkyWest Airlines intends to exchange four 50-seat CRJ200s for four CRJ900s configured with 76 seats in its

Delta Connection operations. On November 30, 2007, we announced that we placed a firm order for 22 aircraft with

Bombardier Aerospace. We are scheduled to take delivery of these aircraft beginning in late 2008 and continue through the

first quarter of 2010.

On January 16, 2008, we announced that SkyWest Airlines has agreed to operate additional aircraft under the

Midwest Services agreement.