SkyWest Airlines 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 SkyWest Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.37

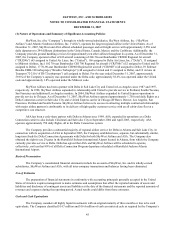

Guarantees

SkyWest has guaranteed the obligations of SkyWest Airlines under the SkyWest Airlines Delta Connection

Agreement and the Midwest Airline Services Agreement and the obligations of ASA under the ASA Delta Connection

Agreement.

New Accounting Standards

In July 2006, the Financial Accounting Standards Board (the “FASB”) issued Interpretation No. 48, Accounting for

Uncertainty in Income Taxes—an interpretation of FASB Statement No. 109 (“FIN No. 48”), which clarifies the accounting

and disclosure for uncertainty in tax positions. FIN No. 48 seeks to reduce the diversity in practice associated with certain

aspects of the recognition and measurement related to accounting for income taxes. We are subject to the provisions of FIN

No.48 as of January 1, 2007, and our management has analyzed filing positions in all of the federal and state jurisdictions

where we are required to file income tax returns, as well as all open tax years in these jurisdictions. The periods subject to

examination for our federal return are the 2004 through 2006 tax years. The adoption of FIN No. 48 did not have a material

effect on our consolidated financial position or results of operations. Our policy for recording interest and penalties on tax

positions is to record such items as a component of the provision for income taxes.

In September 2006, the FASB issued Statement of Financial Accounting Standards (“SFAS”) No. 157, Fair Value

Measurements. This standard defines fair value, establishes a framework for measuring fair value in accounting principles

generally accepted in the United States of America, and expands disclosure about fair value measurements. This

pronouncement applies to other accounting standards that require or permit fair value measurements. Accordingly, this

statement does not require any new fair value measurement. This statement is effective for fiscal years beginning after

November 15, 2007, and interim periods within those fiscal years. Our management does not believe the adoption of this

standard will have a material impact on our consolidated financial position or results of operations.

In February 2007, the FASB issued Statement No. 159, The Fair Value Option for Financial Assets and Financial

Liabilities (Statement 159). Statement 159 allows entities the option to measure eligible financial instruments at fair value as

of specified dates. Such election, which may be applied on an instrument by instrument basis, is typically irrevocable once

elected. Statement 159 is effective for fiscal years beginning after November 15, 2007. Our management does not believe

Statement 159 will result in a material adverse effect on our financial condition, results of operations, or cash flow.

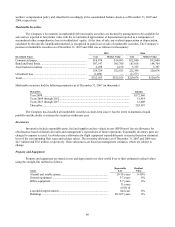

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Aircraft Fuel

Historically, we have not experienced difficulties with fuel availability and we currently expect to be able to obtain

fuel at prevailing prices in quantities sufficient to meet our future needs. Pursuant to our contract flying arrangements, United

and Midwest have agreed to bear the economic risk of fuel price fluctuations on our contracted United Express and Midwest

flights. On our Delta Connection regional jet flights, Delta has agreed to bear the economic risk of fuel price fluctuations. We

bear the economic fuel risk on our pro-rate operations. For the year ended December 31, 2007, contract flying and pro-rate

revenue flying represented approximately 95% and 5%, respectively, of our passenger revenues. As of December 31, 2007,

essentially all of our Brasilia turboprops flown for Delta were flown under pro-rate arrangements, while approximately 38%

of our Brasilia turboprops flown in the United system were flown under pro-rate arrangements. Because third parties bear the

economic risk of fuel price fluctuations on most of our flights, we believe that our results from operations will not be

materially and adversely affected by fuel price volatility.

Interest Rates

Our earnings are affected by changes in interest rates due to the amounts of variable rate long-term debt and the

amount of cash and securities held. The interest rates applicable to variable rate notes may rise and increase the amount of

interest expense. We would also receive higher amounts of interest income on cash and securities held at the time; however,

the market value of our available-for-sale securities would likely decline. At December 31, 2007, we had variable rate notes

representing 49.6% of our total long-term debt compared to 55.4% of our long-term debt at December 31, 2006. For

illustrative purposes only, we have estimated the impact of market risk using a hypothetical increase in interest rates of one

percentage point for both variable rate long-term debt and cash and securities. Based on this hypothetical assumption, we

would have incurred an additional $9.6 million in interest expense and received $6.9 million in additional interest income for

the year ended December 31, 2007 and we would have incurred an additional $10.2 million in interest expense and received

$4.6 million in additional interest income for the year ended December 31, 2006.