Singapore Airlines 2001 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

71 SIA annual report 00/01

Notes to the Financial Statements

31 March 2001

2 Accounting Policies (continued)

(r) Frequent flyer programme

The Company operates a frequent flyer programme called “ KrisFlyer” that provides travel awards to programme members

based on accumulated mileage. In accounting for the mileage credits earned under this programme, the estimated cost of

providing free travel is recognised as an expense and accrued as a liability as mileage credits are accumulated. As members

redeem awards or their entitlements expire, the accrual is reduced accordingly to reflect the acquittal of the outstanding

obligation.

(s) Goodw ill

When subsidiary companies or interests in joint venture and associated companies are acquired, any excess of the consideration

over the fair value of the net assets as at the date of acquisition is included in goodwill and, depending on circumstances in

which the goodwill has arisen, is written-off against Group reserves in the financial year in which it arises. Where the

consideration is lower than fair value of the net assets acquired, the difference is credited to Group reserves. When determining

goodwill, assets and liabilities of the acquired interest are translated using the exchange rate at the date of acquisition if the

financial statements of the acquired interest are not denominated in Singapore dollars.

In August 2000, the ICPAS issued a revised SAS 22, Business Combinations, which provides guidance concerning the accounting

treatment of business combinations. The Company will implement SAS 22 effective 1 April 2001 on a prospective basis. As a

result, the Company will modify its accounting policy to capitalise goodwill arising from future business combinations and

amortise the amount over its estimated useful life.

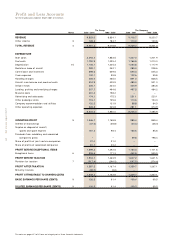

3 Other Income (in $ million)

Other income is derived from:-

The Group The Company

2000 - 2001 1999 - 2000 2000 - 2001 1999 - 2000

Fixed deposits 55.9 96.8 51.3 92.1

Quoted non-equity investments 55.8 53.3 21.8 17.7

Quoted equity investments 4.7 3.2 1.4 1.9

Unquoted trade investments 6.2 3.6 5.4 1.7

Unquoted non-equity investments 2.0 4.6 4.8 4.5

Interest receivable from subsidiary companies – – 25.1 23.8

Interest receivable from other loans 2.0 1.7 0.9 1.0

Interest receivable from associated companies 0.9 0.7 – –

Income from investments and deposits 127.5 163.9 110.7 142.7

Surplus/(loss) on sale of fixed assets other than aircraft

and spares 2.4 (0.8) 2.2 (2.1)

(Loss)/surplus on sale of investments (1.6) 21.6 0.1 –

128.3 184.7 113.0 140.6

4 Segment Information (in $ million)

Revenue earned is generated principally from the carriage of passengers, cargo and mail, the rendering of airport terminal services,

engineering services, air charters and tour wholesaling and related activities. It excludes dividends from subsidiary companies, and in

respect of the Group, inter-company transactions.

The Group The Company

2000 - 2001 1999 - 2000 2000 - 2001 1999 - 2000

External customers 9,951.3 9,018.8 9,149.6 8,253.6

Subsidiary companies – – 80.1 87.7

9,951.3 9,018.8 9,229.7 8,341.3

The Group’s business is organised and managed separately accordingly to the nature of the services provided. Revenues are

attributable to geographical areas based on the airline operations by area of original sale.

The following tables present revenue and profit information regarding business segments for the financial years ended 31 March

2001 and 2000 and certain assets and liabilities information of the business segments as at those dates.