Singapore Airlines 2001 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 SIA annual report 00/01

Financial Review

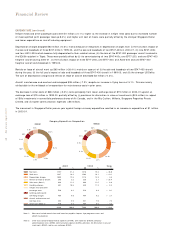

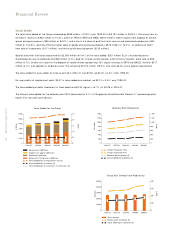

SINGAPORE AIRPORT TERM INAL SERVICES GROUP (continued)

Group expenditure increased by $83.8 million (+13.8% ) to $692.6 million. This was attributable to higher (i) staff costs, (ii) company

accommodation costs, (iii) costs of services rendered by SIA, (iv) material costs, and (v) CAAS licensing fees.

Group shareholders’ funds at 31 March 2001 was $743.5 million, an increase of $132.6 million (+21.7% ) from 31 March 2000.

Total assets was $1,329.2 million, up $244.8 million (+22.6% ) from a year ago.

Capital expenditure was $126.1 million, mainly on the sixth airfreight terminal, the new inflight catering centre, and the second express

courier centre.

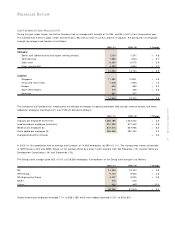

SIA ENGINEERING GROUP

For financial year 2000-01, the operating profit of the SIAEC Group was $122.2 million, up $25.4 million (+26.2% ) from 1999-00.

Profit attributable to shareholders’ funds, after accounting for share of profits of associated and joint venture companies of $4.4 million

after tax, was $115.9 million, down $190.5 million (-62.2% ). The drop was because of the recognition of $202.6 million profit last

year arising from the sale of its 51% equity stake in Eagle Services Asia Pte Ltd (ESA) to Pratt & Whitney Holdings LLC (PWHLLC) in

1998-1999.

Group revenue increased by $87.0 million (+15.3% ) to $654.4 million mainly due to an increase in workload from SIA.

Group expenditure rose $59.8 million (+12.5% ) to $539.9 million mainly because of increases in staff costs, material costs and

production overheads.

Group shareholders’ funds at 31 March 2001 was $466.2 million, up $68.6 million (+17.3% ) from 31 March 2000.

Total assets increased by $137.5 million (+23.1% ) to $731.7 million at 31 March 2001.

Capital expenditure amounted to $20.2 million, largely on engineering plant and equipment.

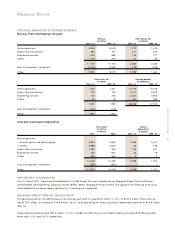

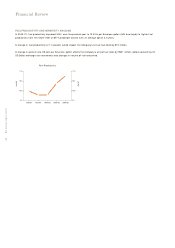

SILKAIR

SilkAir incurred an operating loss of $6.5 million in 2000-01, $1.7 million higher than the previous year. Profit after tax was

$15.4 million, after accounting for a surplus of $15.0 million from the sale of three B737-300 spare engines.

Revenue from scheduled services increased by $0.4 million (+0.2% ) to $170.5 million as traffic rose 0.2% . Overall load factor was

down 2.2 percentage points to 53.1% . Yield improved by 0.1% .

Expenditure was $2.8 million higher (+1.5% ) at $184.7 million mainly from increases in staff costs and fuel costs.

Unit cost dropped 7.0% to 81.5¢/ctk and breakeven load factor was lowered by 4.2 percentage points to 54.0% .

Shareholders’ funds grew 6.2% to $265.3 million at 31 March 2001.

Total assets amounted to $442.0 million at 31 March 2001, an increase of $66.6 million (+17.7% ).

Capital expenditure was $101.6 million, principally on the purchase of one A319 and one A320 passenger aircraft delivered during the

year, and on spare engines and spare parts.

SilkAir’s route network links 18 cities in 8 Asian countries.