Singapore Airlines 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54 SIA annual report 00/01

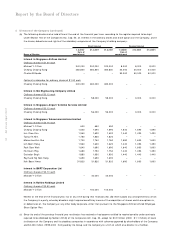

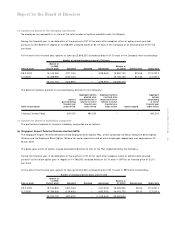

11 Other Significant Acquisition/ Disposal

A Special Board Committee was formed in February 2000 to oversee the Initial Public Offerings of two subsidiary companies,

Singapore Airport Terminal Services Limited (SATS) and SIA Engineering Company Limited (SIAEC).

On 5 May 2000, the Company disposed of vendor shares representing 13.0% equity interests in SATS and SIAEC in connection with

their respective initial public offerings. At Group level, a profit of $440.1 million was recorded after deducting 13.0% of the net

tangible assets of SATS and SIAEC as at the date of disposal.

The Company acquired a 25.0% equity interest in Air New Zealand Limited (ANZ), in two tranches of 8.3% in April 2000 and

16.7% in August 2000, at an aggregate cost of $352.0 million. Goodwill arising from the acquisition amounted to $93.4 million. In

November 2000, the Company subscribed additional shares in ANZ for $51.4 million pursuant to a rights issue, bringing the total

investment in ANZ to $403.4 million.

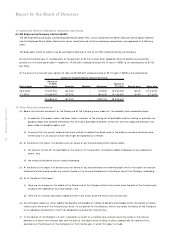

12 Options on Shares in the Company

The Singapore Airlines Limited Employee Share Option Plan (“ the Plan” ), which comprises the Senior Executive Share Option

Scheme and the Employee Share Option Scheme for senior executives and all other employees respectively, was approved by

shareholders on 8 March 2000.

Under the Plan, all options to be issued will have a term no longer than 10 years from the date of grant. The exercise price of the

option will be the average of the closing prices of the Company’s ordinary shares on the SGX-ST for the five market days

immediately preceding the date of grant.

Under the Employee Share Option Scheme, options will vest two years after the date of grant. Under the Senior Executive Share

Option Scheme, options will vest:-

(a) one year after the date of grant for 25% of the ordinary shares subject to the options;

(b) two years after the date of grant for an additional 25% of the ordinary shares subject to the options;

(c) three years after the date of grant for an additional 25% of the ordinary shares subject to the options; and

(d) four years after the date of grant for the remaining 25% of the ordinary shares subject to the options.

The Committee administering the Plan comprises the following directors:-

Michael Y O Fam

Cheong Choong Kong

Lim Chee Onn

Fock Siew Wah

Koh Boon Hwee

Cheong Choong Kong did not participate in any deliberation or decision in respect of options granted to him.

No options have been granted to controlling shareholders or their associates, or parent group employees.

Report by the Board of Directors