Singapore Airlines 2001 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

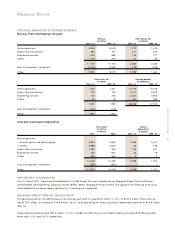

M arket Price Risk

The Company owns $370 million (31 March 2000 : $332 million) in equity and non-equity investments as of 31 March 2001.

The estimated market value of these investments was $376 million (31 March 2000 : $345 million) as of 31 March 2001.

The market risk associated with these investments is the potential loss resulting from a decrease in market prices.

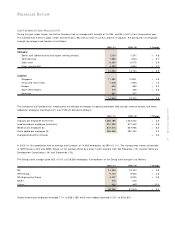

Counter-Party Risk

Surplus funds are invested in interest-bearing bank deposits and other high quality short-term liquid investments. Counter-party risks

are managed by limiting aggregated exposure on all outstanding financial instruments to any individual counter-party, taking into

account its credit rating. Such counter-party exposures are regularly reviewed, and adjusted as necessary. This mitigates the risk of

material loss arising in the event of non-performance by counter-parties.

Liquidity Risk

At 31 March 2001, the Company had at its disposal cash and short-term deposits amounting to $867 million (31 March 2000 :

$944 million). In addition, the Company has available short-term credit facilities of about $500 million.

The Company’s holdings of cash and short-term deposits, together with non-committed funding facilities and net cash flow from

operations, are expected to be sufficient to cover substantially the cost of all firm aircraft deliveries due in the next financial year.

Shortfall, if any, can be met by aircraft financing via structured leases, bank borrowings or public market funding. Because of the

necessity to plan aircraft orders well in advance of delivery, it is not economic for the Company to have committed funding in place

at the present for all outstanding orders, many of which relate to aircraft which will not be delivered for several years. The company’s

policies in this regard are in line with the funding policies of other major airlines.

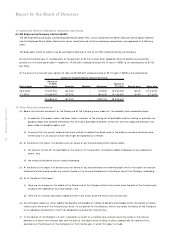

Derivative Financial Instruments

The Company’s policy on the use of derivatives is not to trade in them but to use these instruments as hedges against specific

exposures.

As part of its management of treasury risks, the Company has entered into a number of forward foreign exchange contracts to cover a

portion of future capital, revenue and operating payments in a variety of currencies. The Company uses forward contracts purely as a

hedging tool. It does not take positions in currencies with a view to make speculative gains from currency movements. While it

currently uses only forward contracts, other treasury derivative instruments would be considered on their merits as valid and appropriate

risk management tools and would require the BFC’s approval before adoption.

The Company’s strategy, for managing the risk on fuel price, as defined by BFC, aims to provide the Company with protection against

sudden and significant increases in prices. In meeting these objectives, the fuel risk management programme allows for the judicious

use of instruments such as swaps, options and collars with approved counter-parties and within approval limits.

As derivatives are used for the purpose of risk management, they do not expose the Company to market risk because gains and losses

on the derivatives offset losses and gains on the matching asset, liability, revenues or costs being hedged. Moreover, counter-party

credit risk is generally restricted to any hedging gain from time to time, and not the principal amount hedged. Therefore, the possibility

of material loss arising in the event of non-performance by a counter-party is considered to be unlikely.

50 SIA annual report 00/01

Management of Financial Risks