Singapore Airlines 2001 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2001 Singapore Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37 SIA annual report 00/01

Financial Review

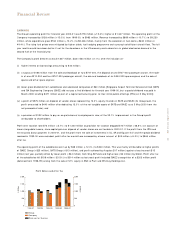

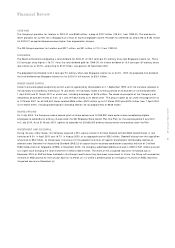

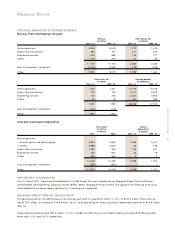

EXPENDITURE

The Airline Company’s expenditure amounted to $8,246 million for 2000-01, $760 million (+10.2% ) more than 1999-00. The SIA

Group’s expenditure grew $755 (+9.6% ) to $8,605 million.

The increase in the Airline Company’s expenditure was due to:-

$ million

Fuel costs (+46.0% ) + 557

Staff costs (+12.1% ) + 145

Sales costs (+6.9% ) +60

Handling charges (+6.3% ) +52

Landing, parking and overflying charges (+2.7% ) +14

Inflight meals and other passenger costs (+0.1% ) +1

Depreciation charges (-5.6% ) –63

Rentals on lease of aircraft (+26.4% ) +60

Aircraft maintenance and overhaul costs (-7.3% ) –38

Other costs (-5.3% ) –28

+ 760

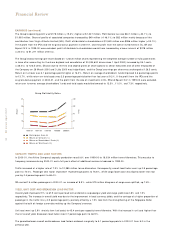

Fuel costs increased by $557 million (+46.0% ) due to:-

$ million

A 36.7% increase in weighted average fuel price + 499

A 6.6% rise in volume of fuel uplifted +84

A 2.6% weakening of Singapore Dollar against the United States Dollar + 47

+ 630

Higher hedging gain –73

+ 557

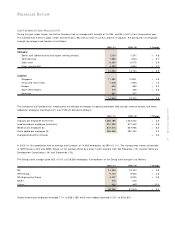

The increase in staff costs of $145 million (+12.1% ) was mainly because of (i) higher provisions for profit-sharing bonus, (ii) wage

adjustments, (iii) service increments, (iv) higher staff strength, and (v) increase in employer’s Central Provident Fund contribution rate

from 10% to 12% with effect from April 2000 and a further increase to 16% with effect from January 2001.

Sales costs rose $60 million (+6.9% ) mainly attributable to (i) higher commission and incentives payable on account of increases in

passenger and cargo revenue, (ii) higher provision for frequent flyer programme costs, and (iii) increased computer reservations

service fees.

The rise in handling charges of $52 million (+6.3% ) was due to higher flight frequencies and rate hikes, partially offset by a stronger

Singapore Dollar.

The rise in landing, parking and overflying charges of $14 million (+2.7% ) was due to higher frequencies and overflying charges,

partially offset by the stronger Singapore Dollar.

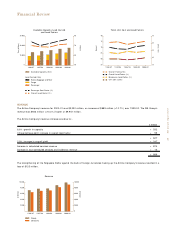

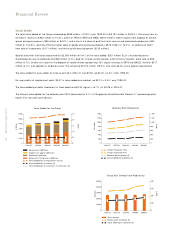

■■■■ Group

■■■■ Company

10,000

8,000

6,000

4,000

2,000

0

10,000

8,000

6,000

4,000

2,000

0

Expenditure

$ Million

$ Million

1996/97 1997/98 1998/99 1999/00 2000/01