Sharp 2010 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

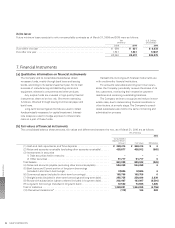

(10) Derivative transactions

As interest-rate swaps are recorded under the pref-

erential accounting method, they are accounted for

as a single item with the underlying bank loans and

current portion of long-term borrowings; which are

hedged transactions. Therefore their fair values are

included in bank loans and current portion of long-

term borrowings. (Please see (5) above.)

(Note 2) As unlisted stocks ¥ 39,487 million ($429,207

thousand) and investments in capital ¥371 million

($4,033 thousand) have no observable market price

and as it is not possible to accurately estimate future

cash flows, it is very difficult to determine their fair

value accurately. Therefore, they are not included in

“(3) Investments in securities; 2) Other securities.”

(Additional Information)

Effective for the year ended March 31, 2010, the

Company and its consolidated subsidiaries have

applied the “Accounting Standard for Financial

Instruments” (ASBJ Statement No. 10, issued by

the ASBJ on March 10, 2008) and the “Guidance on

Disclosures about Fair Value of Financial Instru-

ments” (ASBJ Guidance No. 19, issued by the ASBJ

on March 10, 2008).

8. Business Combinations

Transaction under Common Control

(a) Principal Business Targeted for Transaction Under

Common Control, Legal Method of Business Combina-

tion, Corporate Name after Business Combination and,

Outline and Purpose of the Transaction

(1) Principal Business Targeted for Transaction Under

Common Control

Production and sales of LCD panels and LCD modules

(2) Legal Method of Business Combination

Legal method of business combination is called, a sim-

plified absorption-type corporate split defined under

Japanese Corporate Law (“kani-kyushu-bunkatsu”), in

which the business is split from the Company. Follow-

ing this split, Sharp Display Products Corporation, which

is a consolidated subsidiary of the Company, absorbs

the split business.

(3) Corporate Name after the Business Combination

Sharp Display Products Corporation

(4) Outline and Purpose of the Transaction

The Company’s consolidated subsidiary, Sharp Display

Products Corporation, has succeeded the business, in

the production and sales business, of large-sized LCD

panels and LCD modules, through an absorption-type

corporate split. This transaction allows the production

of large-sized LCD panels and modules, which deliver

the industry’s highest levels of quality, cost and perfor-

mance, maximizing the advantages gained by using the

world’s first 10th generation glass substrates.

(b) Outline of Account Processing

The Company and its domestic consolidated subsidiar-

ies have applied the “Accounting Standard for Business

Combinations” (Business Accounting Council (BAC)

Accounting Standard, issued by the BAC on October

31, 2003) and the “Guidance on Accounting Standard

for Business Combinations and Accounting Standard for

Business Divestitures” (ASBJ Guidance No. 10, issued

by the ASBJ on November 15, 2007) as a commonly-

controlled business combination.

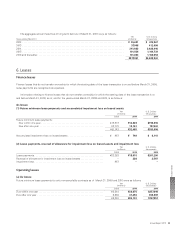

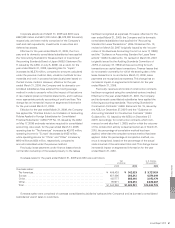

9. Net Assets and Per Share Data

Under the Japanese Corporate Law (“the Law”), the entire

amount paid for new shares is required to be designated as

common stock. However, a company may, by a resolution of

the Board of Directors, designate an amount not exceeding

one-half of the price of the new shares as additional paid-in

capital, which is included in capital surplus.

Under the Law, in cases where a dividend distribution of

surplus is made, the smaller of an amount equal to 10% of

the dividend or the excess, if any, of 25% of common stock

over the total of legal earnings reserve and additional paid-in

capital must be set aside as legal earnings reserve or

additional paid-in capital. Legal earnings reserve is included

in retained earnings in the accompanying consolidated bal-

ance sheets.

As of March 31, 2010, the total amount of legal earnings

reserve and additional paid-in capital exceeded 25% of the

common stock, therefore, no additional provision is required.

Legal earnings reserve and additional paid-in capital may not

be distributed as dividends. By the resolution of shareholders’

meeting, legal earnings reserve and additional paid-in capital may

be transferred to other retained earnings and capital surplus,

respectively, which are potentially available for dividends.

Financial Section

SHARP CORPORATION56