Sharp 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

If the fair market value of other securities declines signifi-

cantly, such securities are stated at fair market value and the

difference between the fair market value and the carrying

amount is recognized as loss in the period of decline. If the

net asset value of other securities with no available fair

market values declines significantly, the securities are written

down to the net asset value and charged to income. In these

cases, the fair market value or the net asset value is carried

forward to the next year.

(f) Inventories

Inventories held by the Company and its domestic consoli-

dated subsidiaries are primarily stated at moving average

cost (for balance sheet valuation, in the event that an impair-

ment is determined inventories impairment is computed

using net realizable value). For overseas consolidated subsid-

iaries, inventories are stated at the lower of moving average

cost or market.

(g) Depreciation and amortization

For the Company and its domestic consolidated subsidiaries,

depreciation of plant and equipment, other than lease assets

is computed using the declining-balance method, except for

machinery and equipment at the LCD plants in Mie,

Kameyama and Sakai, as well as buildings (excluding attached

structures) acquired by the Company and its domestic consoli-

dated subsidiaries on and after April 1, 1998; All of which are

depreciated using the straight-line method over the estimated

useful life of the asset. Properties at overseas consolidated

subsidiaries are depreciated using the straight-line method.

Maintenance and repairs, including minor renewals and

betterments, are charged to income as incurred.

Amortization of intangible assets except for lease assets

is computed using the straight-line method.

Depreciation of lease assets under finance leases that do

not transfer ownership is computed using the straight-line

method, using the lease period as the depreciable life and the

residual value as zero. Finance leases of the Company and its

domestic consolidated subsidiaries that do not transfer own-

ership, for which the starting date of the lease transaction is

on and before March 31, 2008, lease payments are recog-

nized as expenses.

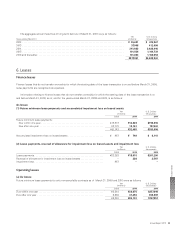

(h) Accrued bonuses

The Company and its domestic consolidated subsidiaries

accrue estimated amounts of employees’ bonuses based on

the estimated amounts to be paid in the subsequent period.

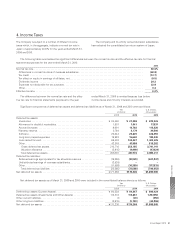

(i) Income taxes

The asset and liability approach is used to recognize deferred

tax assets and liabilities for the expected future tax conse-

quences of temporary differences between the carrying

amounts of assets and liabilities for financial reporting pur-

poses and the amounts used for income tax purposes.

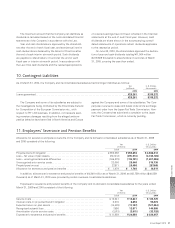

(j) Severance and pension benefits

The Company and its domestic consolidated subsidiaries

have primarily a trustee noncontributory defined benefit pen-

sion plan for their employees to supplement a governmental

welfare pension plan.

Certain overseas consolidated subsidiaries primarily have

defined contribution pension plans and lump-sum retirement

benefit plans.

The Company and its domestic consolidated subsidiaries

provide an allowance for severance and pension benefits

based on the estimated amounts of projected benefit obliga-

tion and the fair value of plan assets at the balance sheet

date. Projected benefit obligation and expenses for severance

and pension benefits are determined based on the amounts

actuarially calculated using certain assumptions.

Prior service costs are amortized using the straight-line

method over the average of the estimated remaining service

years (16 years) commencing with the current period. Actu-

arial gains and losses are primarily amortized using the

straight-line method over the average of the estimated

remaining service years (16 years) commencing with the

following period.

(k) Research and development expenses and

software costs

Research and development expenses are charged to income

as incurred. The research and development expenses are

charged to income amounted to ¥195,525 million and

¥166,507 million ($1,809,859 thousand) for the years ended

March 31, 2009 and 2010, respectively.

Software costs are recorded principally in other assets.

Software used by the Company is amortized using the

straight-line method over the estimated useful life of princi-

pally 5 years, and software embedded in products is amor-

tized over the forecasted sales quantity.

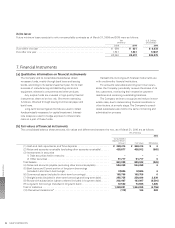

(l) Derivative financial instruments

The Company and some of its consolidated subsidiaries use

derivative financial instruments, including foreign exchange

forward contracts and interest rate swap agreements, in order

to hedge the risk of fluctuations in foreign currency exchange

rates and interest rates associated with assets and liabilities

denominated in foreign currencies and debt obligations.

All derivative financial instruments are stated at fair value

and recorded on the balance sheets. The deferred method is

used for recognizing gains or losses on hedging instruments

and the hedged items. When foreign exchange forward con-

tracts meet certain conditions, the hedged items are stated

by the forward exchange contract rates.

Financial Section

SHARP CORPORATION48