Sharp 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

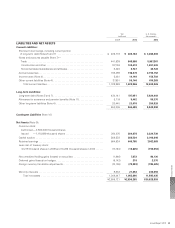

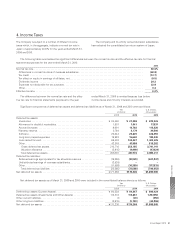

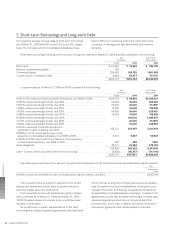

5. Short-term Borrowings and Long-term Debt

The weighted average interest rates of short-term borrowings

as of March 31, 2009 and 2010 were 0.8% and 0.4%, respec-

tively. The Company and its consolidated subsidiaries have

had no difficulty in renewing such loans when loans have

come due or management has determined such renewal

advisable.

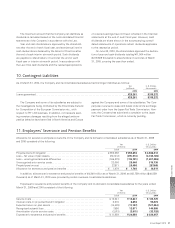

Short-term borrowings including current portion of long-term debt as of March 31, 2009 and 2010 consisted of the following:

Yen

(millions)

U.S. Dollars

(thousands)

2009 2010 2010

Bank loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 61,345 ¥ 70,452 $ 765,783

Bankers’ acceptances payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163 – –

Commercial paper . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 335,426 165,755 1,801,685

Current portion of long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,839 65,977 717,141

¥405,773 ¥302,184 $3,284,609

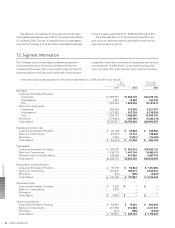

Long-term debt as of March 31, 2009 and 2010 consisted of the following:

Yen

(millions)

U.S. Dollars

(thousands)

2009 2010 2010

0.0%–5.2% unsecured loans principally from banks, due 2009 to 2024 . . . . . . . . ¥100,178 ¥ 99,994 $1,086,891

0.620% unsecured straight bonds, due 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,000 30,000 326,087

0.970% unsecured straight bonds, due 2012. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20,000 20,000 217,391

1.165% unsecured straight bonds, due 2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000 10,000 108,696

1.423% unsecured straight bonds, due 2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 30,000 30,000 326,087

2.068% unsecured straight bonds, due 2019. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,000 10,000 108,696

0.846% unsecured straight bonds, due 2014. . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 100,000 1,086,957

1.141% unsecured straight bonds, due 2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 20,000 217,391

1.604% unsecured straight bonds, due 2019 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 30,000 326,087

0.000% unsecured convertible bonds with

subscription rights to shares, due 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 203,211 202,497 2,201,054

0.950%–1.177% unsecured Euroyen notes

issued by a consolidated subsidiary, due 2009 to 2013 . . . . . . . . . . . . . . . . . . . .

5,818

5,057

54,967

0.400%–0.700% unsecured Pound discount notes issued by

a consolidated subsidiary, due 2009 to 2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . .

502

698

7,587

lease obligations. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23,271 25,682 279,152

432,980 583,928 6,347,043

Less – Current portion included in short-term borrowings . . . . . . . . . . . . . . . . . . . (8,839) (65,977) (717,141)

¥424,141 ¥517,951 $5,629,902

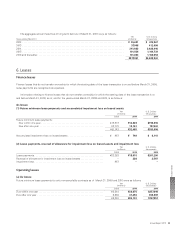

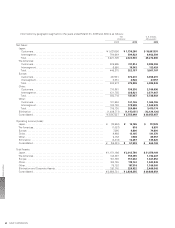

The following is a summary of the terms for conversion and redemption of the convertible bonds with subscription rights to shares:

Yen

Conversion

price

0.000% unsecured convertible bonds with subscription rights to shares, due 2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥2,531.00

The conversion price is subject to adjustment for certain

subsequent events such as the issue of common stock at

less than market value and stock splits.

If all convertible bonds with subscription rights to shares

were converted as of March 31, 2009 and March 31, 2010,

79,018 thousand shares of common stock would have been

issuable, in both years.

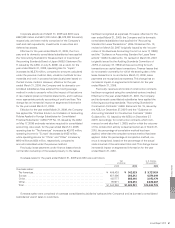

As is customary in Japan, substantially all of the bank

borrowings are subject to general agreements with each bank

which provide, among other things, that security and guaran-

tees for present and future indebtedness will be given upon

request of the bank, and that any collateral so furnished will

be applicable to all indebtedness to that bank. In addition, the

agreements provide that the bank has the right to offset cash

deposited against any short-term or long-term debt that

becomes due, and in case of default and certain other speci-

fied events, against all other debts payable to the bank.

Financial Section

SHARP CORPORATION52