Sharp 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Large-size LCDs/LCD TVs

With demand in emerging countries growing faster than expected,

supplies of LCD panels for TVs are projected to remain tight until

fiscal 2011. The increasing popularity of LED TVs and 3D TVs is

another key dynamic in this market. Only a few manufacturers in

the world can supply panels with high definition and brightness

required by these new technologies.

In order to meet the strong demand for high-performance panels,

we increased input capacity at the LCD panel plant in GREEN FRONT

SAKAI to 72,000 glass substrates per month. This plant produces

highly competitive LCD panels that feature Sharp’s proprietary tech-

nologies like UV2A technology and four-primary-color technology.

In the LCD TV business, we plan to increase sales by focusing

on our AQUOS Quattron models, which combine our UV2A tech-

nology and four-primary-color technology, and launching an

AQUOS Quattron 3D TV. We plan to have AQUOS Quattron TVs in

stores worldwide by the end of fiscal 2010. I am confident this will

add impetus to our brand restructuring. Concurrently, we will

convert all of our TVs to LED-backlit models. However, the supply

of LED chips is limited. As eliminating procurement risk is a key

factor in our business expansion, we have established cross-

licensing agreements with major LED manufacturers and started

making these chips ourselves. This will give us a well-balanced

framework for procuring LED chips. We started making blue LED

chips early in 2010 at our Mihara Plant and will begin mass pro-

duction at the Fukuyama Plant by the end of fiscal 2010. I am

confident that these initiatives will allow us to keep up with rapid

growth in demand for LED TVs.

Please explain your views of market conditions for Sharp’s core businesses and your strategies for achieving growth.

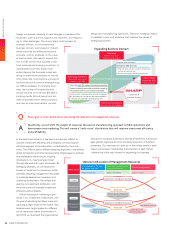

LCD/LCD TV Business

In the large-size LCD and LCD TV category, we plan to rebuild the Sharp brand around our proprietary LCD technology. For

small- and medium-size LCDs, we plan to improve profitability by utilizing continuous grain silicon (CG-Silicon) technology.

Sharp’s Strategies for Growth

Small- and Medium-size LCDs

The market for small- and medium-size LCDs remained difficult in

fiscal 2009 and the oversupply of these panels is likely to con-

tinue. But there is good news, too. Display functionality and defini-

tion are expected to improve as new applications like

smartphones and e-books emerge. The 3D touch panel is a prime

example of this trend. As demand climbs, I expect to see a supply

shortage of high value-added LCDs.

Amid these trends, in April 2010, we unveiled a 3D touch-

screen LCD that incorporates an advanced version of our CG-Silicon

technology, which is a key strength of ours in the LCD field. We

want to improve profitability in our small- and medium-size LCD

business by increasing sales of high value-added displays, a market

sector where we are very competitive.

Q

A

Interview with the President

Annual Report 2010 09