Sharp 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

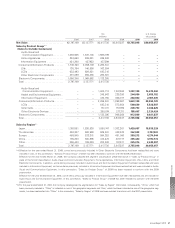

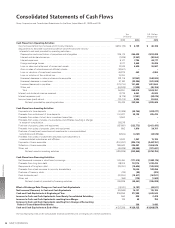

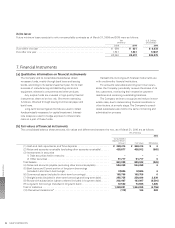

Consolidated Statements of Cash Flows

Sharp Corporation and Consolidated Subsidiaries for the Years Ended March 31, 2009 and 2010

Yen

(millions)

U.S. Dollars

(thousands)

2009 2010 2010

Cash Flows from Operating Activities:

Income (loss) before income taxes and minority interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥(204,139) ¥ 6,139 $ 66,728

Adjustments to reconcile income (loss) before income taxes and minority

interests to net cash provided by operating activities—

Depreciation and amortization of properties and intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . 305,115 264,429 2,874,228

Interest and dividends income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,009) (3,547) (38,554)

Interest expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,147 7,794 84,717

Foreign exchange losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,217 3,609 39,229

Loss on sales and retirement of noncurrent assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10,576 4,930 53,587

Gain on sales of subsidiaries and affiliate’s stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18,521) – –

Loss on valuation of investment securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49,875 442 4,804

Loss on violation of the antitrust law. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,004 – –

(Increase) decrease in notes and accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 102,119 (87,301) (948,924)

(Increase) decrease in inventories. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,180 (22,250) (241,848)

Increase (decrease) in payables. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (175,734) 131,698 1,431,500

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (53,539) (7,425) (80,706)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 59,291 298,518 3,244,761

Interest and dividends income received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,735 4,041 43,924

Interest expenses paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,179) (7,551) (82,076)

Income taxes (paid) refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (33,412) 8,556 93,000

Net cash provided by operating activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,435 303,564 3,299,609

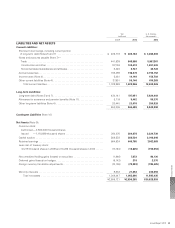

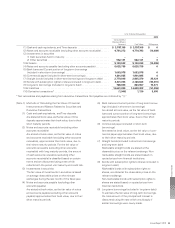

Cash Flows from Investing Activities:

Payments into time deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (74,089) (39,764) (432,217)

Proceeds from withdrawal of time deposits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104,027 39,138 425,413

Proceeds from sales of short-term investment securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,500 – –

Proceeds from sales of stocks of subsidiaries and affiliates resulting in change

in scope of consolidation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,278 – –

Purchase of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (237,801) (222,772) (2,421,435)

Proceeds from sales of property, plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 893 1,910 20,761

Purchase of investment securities and investments in nonconsolidated

subsidiaries and affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (5,504) (4,101) (44,576)

Proceeds from sales of investment securities and investments in

nonconsolidated subsidiaries and affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,843 1,207 13,120

Payments of loans receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (304,267) (226,114) (2,457,761)

Collection of loans receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 306,520 226,281 2,459,576

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (46,629) (29,590) (321,631)

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (222,229) (253,805) (2,758,750)

Cash Flows from Financing Activities:

Net (decrease) increase in short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 163,494 (171,315) (1,862,119)

Proceeds from long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 88,912 157,174 1,708,413

Repayments of long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (35,031) (15,634) (169,935)

Proceeds from stock issuance to minority shareholders . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 10,000 108,696

Purchase of treasury stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (176) (80) (870)

Cash dividends paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30,804) (15,411) (167,511)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (166) (175) (1,902)

Net cash (used in) provided by financing activities. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186,229 (35,441) (385,228)

Effect of Exchange Rate Change on Cash and Cash Equivalents . . . . . . . . . . . . . . . . . . . . . . . . . (12,001) (4,187) (45,511)

Net Increase (Decrease) in Cash and Cash Equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22,566) 10,131 110,120

Cash and Cash Equivalents at Beginning of Year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 339,266 317,358 3,449,543

Increase in Cash and Cash Equivalents from Newly Consolidated Subsidiary . . . . . . . . . . . . . 550 228 2,478

Increase in Cash and Cash Equivalents resulting from Merger . . . . . . . . . . . . . . . . . . . . . . . . . . 108 69 750

Increase in Cash and Cash Equivalents resulting from Change of Accounting

Period of Consolidated Subsidiaries . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 339 3,685

Cash and Cash Equivalents at End of Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 317,358 ¥ 328,125 $ 3,566,576

The accompanying notes to the consolidated financial statements are an integral part of these statements.

Financial Section

SHARP CORPORATION46