Sharp 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

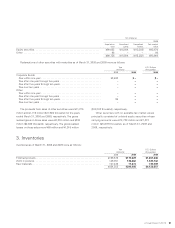

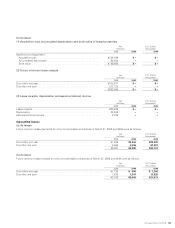

Overseas sales for the years ended March 31, 2008 and 2009 were as follows:

Yen

(millions)

U.S. Dollars

(thousands)

2008 2009 2009

Overseas sales:

The Americas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 625,841 ¥ 488,428 $ 5,035,340

Europe. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 584,252 451,090 4,650,413

China. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 412,470 407,777 4,203,887

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 204,426 197,671 2,037,845

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥1,826,989 ¥1,544,966 $15,927,485

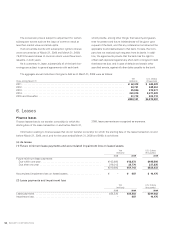

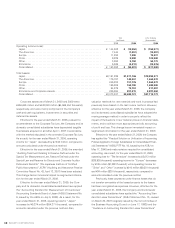

(ASBJ Guidance No. 16, revised on March 30, 2007 (originally

issued by the Auditing Standards Committee of JICPA on

January 18, 1994)) and are accounting for such transactions as

capital lease transactions. Finance leases that do not transfer

ownership for which the starting date of the lease transaction

is on and before to March 31, 2008, lease payments are rec-

ognized as expenses. This change has an immaterial impact

on segmented information for the year ended March 31, 2009.

Overseas sales were comprised of overseas consolidated

subsidiaries’ sales and the Company’s and its domestic con-

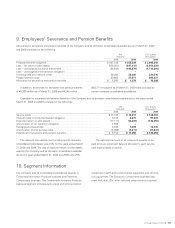

11. Restructuring Charges

solidated subsidiaries’ export sales to customers.

These restructuring charges are mainly related to the reorga-

nization of LCD plants, including depreciation and mainte-

nance charges of ¥43,051 million ($443,825 thousand)

concerning plants that are suspended due to centralization

and optimization of LCD production and impairment losses of

fixed assets of ¥9,468 million ($97,608 thousand).

(Impairment Loss)

With regards to application of accounting for impairment

assets, the Company and its consolidated subsidiaries identi-

fies cash generating units in consideration of business charac-

teristics and business operation. As a result, idle assets are

identified as respective cash generating units.

As a part of the reorganization of LCD plants, the Com-

pany and its consolidated subsidiaries mainly reduced the

book value of LCD production facilities which are expected not

to be used to recoverable amount, and recognized the

decreased amount of ¥9,468 million ($97,608 thousand) as

restructuring charges categorized in Other Income (Expenses)

for the year ended March 31, 2009.

Details are as follows: ¥4,926 million ($50,784 thousand), for

machinery and equipment; ¥1,262 million ($13,010 thousand),

for buildings and structures; ¥3,280 million ($33,814 thousand),

for the others.

The recoverable amount of those impaired assets was

measured using their net realizable values, and net realizable

values of impaired assets that are not expected to be sold are

regarded as zero.