Sharp 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

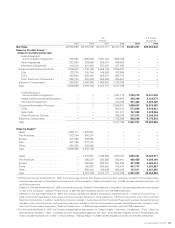

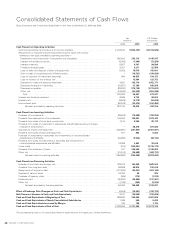

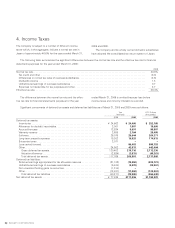

Sharp Corporation and Consolidated Subsidiaries for the Years Ended March 31, 2008 and 2009

Yen

(millions)

U.S. Dollars

(thousands)

2008 2009 2009

Cash Flows from Operating Activities:

Income (loss) before income taxes and minority interests . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 162,240 ¥(204,139) $(2,104,526)

Adjustments to reconcile income (loss) before income taxes and minority

interests to net cash provided by operating activities—

Depreciation and amortization of properties and intangibles . . . . . . . . . . . . . . . . . . . . . . . . . . . 265,640 305,115 3,145,515

Interest and dividends income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,086) (7,009) (72,258)

Interest expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,957 9,147 94,299

Foreign exchange losses. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,067 2,217 22,856

Loss on sales and disposal of plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,039 10,576 109,031

Gain on sales of subsidiaries and affiliate’s stocks . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – (18,521) (190,938)

Loss on valuation of investment securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 694 49,875 514,175

Loss on violation of the antitrust law . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 12,004 123,753

Decrease in notes and accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,931 102,119 1,052,773

Decrease (increase) in inventories . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (24,557) 27,180 280,206

Decrease in payables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (28,200) (175,734) (1,811,691)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (15,803) (53,539) (551,948)

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 376,922 59,291 611,247

Interest and dividends received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,939 8,735 90,052

Interest paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (9,849) (9,179) (94,629)

Income taxes paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (52,248) (33,412) (344,454)

Net cash provided by operating activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 323,764 25,435 262,216

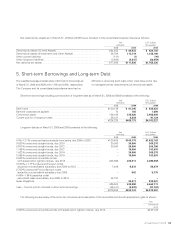

Cash Flows from Investing Activities:

Purchase of time deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (99,502) (74,089) (763,804)

Proceeds from redemption of time deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105,364 104,027 1,072,443

Proceeds from sales of short-term investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,514 2,500 25,773

Proceeds from sales of investment in subsidiaries and affiliates resulting in change

of scope of consolidation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . – 28,278 291,526

Acquisitions of plant and equipment. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (362,927) (237,801) (2,451,557)

Proceeds from sales of plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 871 893 9,206

Purchase of investments in securities and investments in nonconsolidated

subsidiaries and affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (54,994) (5,504) (56,742)

Proceeds from sales of investments in securities and investments in

nonconsolidated subsidiaries and affiliates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,385 3,843 39,619

Loans made . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (510) (304,267) (3,136,773)

Proceeds from collection of loans. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 347 306,520 3,160,000

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,510) (46,629) (480,711)

Net cash used in investing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (394,962) (222,229) (2,291,020)

Cash Flows from Financing Activities:

Increase in short-term borrowings, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 128,472 163,494 1,685,505

Proceeds from long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 89,898 88,912 916,618

Repayments of long-term debt. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (121,994) (35,031) (361,144)

Disposal of treasury stock. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,786 80 825

Purchase of treasury stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (369) (176) (1,814)

Dividends paid. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (30,530) (30,804) (317,567)

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,169) (246) (2,536)

Net cash provided by financing activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 84,094 186,229 1,919,887

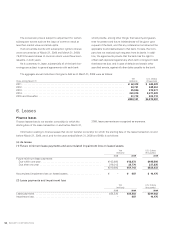

Effect of Exchange Rate Changes on Cash and Cash Equivalents. . . . . . . . . . . . . . . . . . . . . . . . (4,549) (12,001) (123,722)

Net (Decrease) Increase in Cash and Cash Equivalents . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8,347 (22,566) (232,639)

Cash and Cash Equivalents at Beginning of Year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 329,286 339,266 3,497,588

Cash and Cash Equivalents of Newly Consolidated Subsidiaries . . . . . . . . . . . . . . . . . . . . . . . . 1,439 550 5,670

Cash and Cash Equivalents Increased by Merger . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 194 108 1,113

Cash and Cash Equivalents at End of Year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 339,266 ¥ 317,358 $ 3,271,732

The accompanying notes to the consolidated financial statements are an integral part of these statements.