Sharp 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

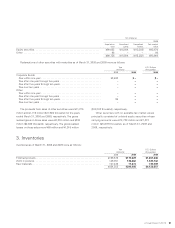

8. Contingent Liabilities

respectively, which are potentially available for dividends.

The maximum amount that the Company can distribute as

dividends is calculated based on the nonconsolidated financial

statements of the Company in accordance with the Law.

Year end cash dividends are approved by the shareholders

after the end of each fiscal year, and semiannual interim cash

dividends are declared by the Board of Directors after the end

of each interim six-month period. Such dividends are payable

to shareholders of record at the end of each fiscal year or

interim six-month period. In accordance with the Law, final

cash dividends and the related appropriations of retained earn-

ings have not been reflected in the financial statements at the

end of such fiscal year. However, cash dividends per share

shown in the accompanying consolidated statements of oper-

ations reflect dividends applicable to the respective period.

On June 23, 2009, the shareholders approved the declara-

tion of year end cash dividends totaling ¥7,703 million

($79,412 thousand) to shareholders of record as of March 31,

2009, covering the year then ended.

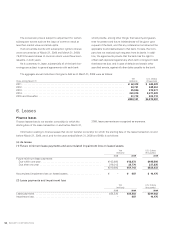

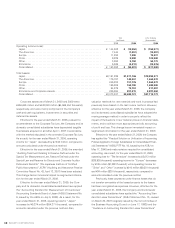

As of March 31, 2009, the Company and its consolidated subsidiaries had contingent liabilities as follows:

Yen

(millions)

U.S. Dollars

(thousands)

2009 2009

Loans guaranteed. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥27,351 $281,969

¥27,351 $281,969

The Company and some of its subsidiaries are subject to

the investigations conducted by the Directorate-General for

Competition of the European Commission etc. with respect to

TFT LCD business. In addition, civil lawsuits seeking monetary

damages resulting from the alleged anticompetitive behavior

have been filed in North America against the Company and

some of its subsidiaries. With respect to the investigation

conducted by the United States Department of Justice, the

Company agreed to pay a fine and so on. The Company also

received a cease and desist order and a surcharge payment

order from the Japan Fair Trade Commission.

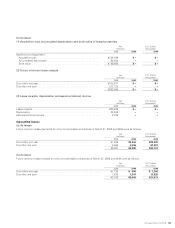

7. Net Assets and Per Share Data

Under the Japanese Corporate Law (“the Law”), the entire

amount paid for new shares is required to be designated as

common stock. However, a company may, by a resolution of

the Board of Directors, designate an amount not exceeding

one-half of the price of the new shares as additional paid-in

capital, which is included in capital surplus.

Under the Law, in cases where a dividend distribution of

surplus is made, the smaller of an amount equal to 10% of the

dividend or the excess, if any, of 25% of common stock over

the total of legal earnings reserve and additional paid-in capital

must be set aside as legal earnings reserve or additional paid-

in capital. Legal earnings reserve is included in retained earn-

ings in the accompanying consolidated balance sheets.

As of March 31, 2009, the total amount of legal earnings

reserve and additional paid-in capital exceeded 25% of the

common stock, therefore, no additional provision is required.

Legal earnings reserve and additional paid-in capital may not

be distributed as dividends. By the resolution of shareholders’

meeting, legal earnings reserve and additional paid-in capital may

be transferred to other retained earnings and capital surplus,