Sharp 2009 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

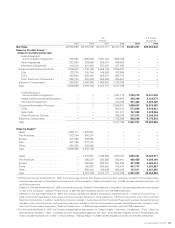

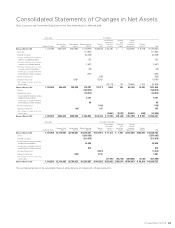

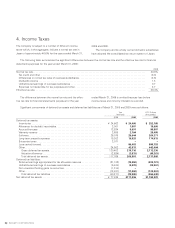

Sharp Corporation and Consolidated Subsidiaries for the Years Ended March 31, 2008 and 2009

(thousands) Yen (millions)

Number of shares

Common stock

(Note 7)

Capital surplus

(Note 7)

Retained earnings

(Note 7)

Treasury

stock

Net unrealized

holding gains

(losses) on

securities

Deferred

gains

(losses) on

hedges

Foreign

currency

translation

adjustments

Minority

interests Total

Balance at March 31, 2007

1,110,699 ¥ 204,676 ¥ 262,295 ¥ 745,209 ¥ (26,844) ¥ 24,381 ¥ 1 ¥ (26,591) ¥ 9,078 ¥ 1,192,205

Net income

101,922 101,922

Dividends from surplus

(30,538) (30,538)

Increase resulting from increase in

number of consolidated subsidiaries

192 192

D e cre a se r e sul t ing f rom incr e ase

in number of consolidated subsidiaries

(1,597) (1,597)

D e cre a se r e sul t ing f rom incr e ase

in number of equity method affiliates

(29) (29)

Increase due to unfunded retirement

benefit obligation of foreign subsidiaries

1,228 1,228

Purchase of treasury stock

(369) (369)

Disposal of treasury stock

6,287 13,502 19,789

N et c han g es o f i t ems othe r t h an

owners’ equity

(22,719) 144 (19,564) 1,204 (40,935)

Balance at March 31, 2008

1,110,699 204,676 268,582 816,387 (13,711) 1,662 145 (46,155) 10,282 1,241,868

Net loss

(125,815) (125,815)

Dividends from surplus

(30,814) (30,814)

Increase resulting from change in accounting

standards of foreign subsidiaries

5,101 5,101

Increase due to unfunded retirement

benefit obligation of foreign subsidiaries

65 65

Purchase of treasury stock

(176) (176)

Disposal of treasury stock

(44) 147 103

N et c han g es o f i t ems othe r t h an

owners’ equity

(3,608) (9,287) (28,041) (949) (41,885)

Balance at March 31, 2009

1,110,699 ¥204,676 ¥268,538 ¥ 664,924 ¥(13,740) ¥ (1,946) ¥(9,142) ¥(74,196) ¥ 9,333 ¥1,048,447

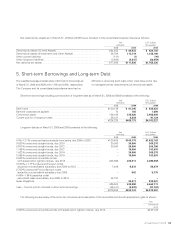

(thousands) U.S. Dollars (thousands)

Number of shares

Common stock

(Note 7)

Capital surplus

(Note 7)

Retained earnings

(Note 7)

Treasury

stock

Net unrealized

holding gains

(losses) on

securities

Deferred

gains

(losses) on

hedges

Foreign

currency

translation

adjustments

Minority

interests Total

Balance at March 31, 2008

1,110,699 $2,110,062 $2,768,887 $ 8,416,361 $(141,351) $ 17,134 $ 1,495 $(475,825) $106,000 $12,802,763

Net loss

(1,297,062) (1,297,062)

Dividends from surplus

(317,670) (317,670)

Increase resulting from change in accounting

standards of foreign subsidiaries

52,588 52,588

Increase due to unfunded retirement

benefit obligation of foreign subsidiaries

670 670

Purchase of treasury stock

(1,814) (1,814)

Disposal of treasury stock

(454) 1,515 1,061

N et c han g es o f i t ems othe r th an

owners’ equity

(37,196) (95,742) (289,082) (9,784) (431,804)

Balance at March 31, 2009

1,110,699 $2,110,062 $2,768,433 $ 6,854,887 $(141,650) $(20,062) $(94,247) $(764,907) $ 96,216 $10,808,732

The accompanying notes to the consolidated financial statements are an integral part of these statements.