Sharp 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Sharp annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

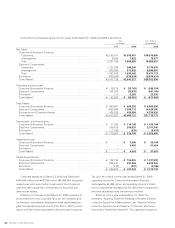

Corporate assets as of March 31, 2008 and 2009 were

¥464,645 million and ¥442,849 million ($4,565,454 thousand),

respectively, and were mainly comprised of the Company’s

cash and cash equivalents, investments in securities and

deferred tax assets.

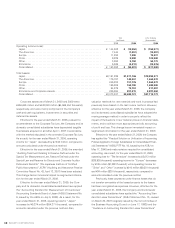

Effective for the year ended March 31, 2008, pursuant to

an amendment to the Corporate Tax Law, the Company and its

domestic consolidated subsidiaries have depreciated tangible

fixed assets acquired on and after April 1, 2007 in accordance

with the method stipulated in the amended Corporate Tax Law.

As a result, for the year ended March 31, 2008, operating

income for “Japan” decreased by ¥7,234 million, compared to

amounts calculated under the previous method.

Effective for the year ended March 31, 2008, the amended

“Auditing Treatment Relating to Reserve Defined under the

Special Tax Measurement Law, Reserve Defined under the

Special Law and Reserve for Director and Corporate Auditor

Retirement Benefits” (The Japanese Institute of Certified

Public Accountants (“JICPA”) Auditing and Assurance Practice

Committee Report No. 42, April 13, 2007) have been adopted.

This change had an immaterial impact on segmented informa-

tion for the year ended March 31, 2008.

Effective for the year ended March 31, 2009, the Com-

pany and its domestic consolidated subsidiaries have applied

the “Accounting Standard for Measurement of Inventories”

(Accounting Standards Board of Japan (ASBJ) Statement No.

9, issued by the ASBJ on July 5, 2006). As a result, for the

year ended March 31, 2009, operating loss for “Japan”

increases by ¥5,274 million ($54,371 thousand), compared to

amounts calculated under the previous method. Also,

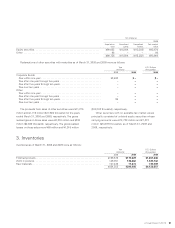

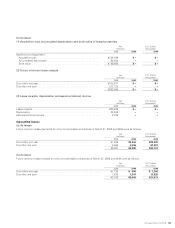

Yen

(millions)

U.S. Dollars

(thousands)

2008 2009 2009

Operating Income (Loss):

Japan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 144,502 ¥ (74,552) $ (768,577)

The Americas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,444 (1,057) (10,897)

Europe. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,280 7,395 76,237

China. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,835 9,988 102,969

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,683 5,158 53,175

Elimination . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,948 (2,413) (24,876)

Consolidated . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 183,692 ¥ (55,481) $ (571,969)

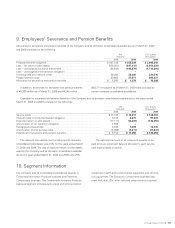

Total Assets:

Japan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥2,161,836 ¥1,871,166 $19,290,371

The Americas . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 175,767 142,267 1,466,670

Europe. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 246,833 151,735 1,564,278

China. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 186,909 163,785 1,688,505

Other. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94,978 78,753 811,887

Elimination and Corporate Assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 206,884 281,015 2,897,062

Consolidated . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥3,073,207 ¥2,688,721 $27,718,773

valuation methods for raw materials and work in process had

previously been based on the last invoice method. However,

effective for the year ended March 31, 2009, the Company

and its domestic consolidated subsidiaries have adopted the

moving average method in order to properly reflect the

impact of fluctuations in raw material prices on financial state-

ments, and to achieve more appropriate periodic accounting

of profit and loss. This change has an immaterial impact on

segmented information for the year ended March 31, 2009.

Effective for the year ended March 31, 2009, the Company

has applied the “Practical Solution on Unification of Accounting

Policies Applied to Foreign Subsidiaries for Consolidated Finan-

cial Statements” (ASBJ PITF No. 18, issued by the ASBJ on

May 17, 2006) and made revisions required for consolidated

accounting. As a result, for the year ended March 31, 2009,

operating loss for “The Americas” increases by ¥2,613 million

($26,938 thousand), operating income for “Europe” decreases

by ¥135 million ($1,392 thousand), while operating income for

“China” and “Other” increase by ¥910 million ($9,381 thousand)

and ¥34 million ($351 thousand), respectively, compared to

amounts calculated under the previous method.

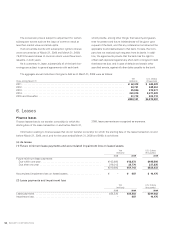

Previously, lease payments under finance leases that do

not transfer ownership of the leased property to the lessee

had been recognized as expenses. However, effective for the

year ended March 31, 2009, the Company and its domestic

consolidated subsidiaries have applied the “Accounting Stan-

dard for Lease Transactions” (ASBJ Statement No. 13, revised

on March 30, 2007 (originally issued by the 1st committee of

the Business Accounting Council on June 17, 1993)) and the

“Guidance on Accounting Standard for Lease Transactions”