Seagate 2002 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

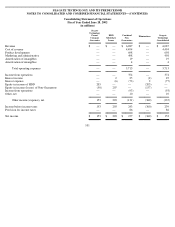

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

Distributions

During fiscal year 2003, the Company made distributions to its shareholders totaling $288 million consisting of a $262 million

distribution immediately prior to the Company’s initial public offering in December 2002, and pursuant to the Company’s quarterly dividend

policy, approximately $13 million in distributions in each of February 2003 and May 2003. During fiscal year 2002, the Company made

distributions to its shareholders totaling $200 million consisting of a $33 million distribution in March 2002 and a $167 million distribution in

May 2002.

On July 14, 2003, our board of directors declared a quarterly distribution of $0.04 per share to be paid on or before August 22, 2003 to

our shareholders of record as of August 8, 2003.

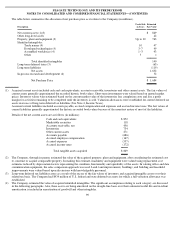

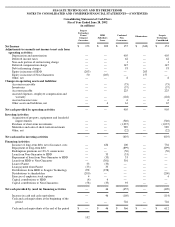

10. Commitments

Leases —The Company leases certain property, facilities and equipment under non-cancelable lease agreements. Land and facility leases

expire at various dates through 2027 and contain various provisions for rental adjustments including, in certain cases, a provision based on

increases in the Consumer Price Index. All of the leases require the Company to pay property taxes, insurance and normal maintenance costs.

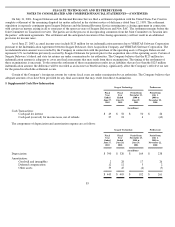

Future minimum lease payments for operating leases with initial or remaining terms of one year or more were as follows at June 27, 2003

(lease payments are shown net of sublease income):

Total rent expense for all land, facility and equipment operating leases was approximately $24 million, $23 million, $17 million and $11

million for fiscal years 2003 and 2002 and for the periods from November 23, 2000 to June 29, 2001 and July 1, 2000 to November 22, 2000,

respectively. Total sublease rental income for fiscal years 2003 and 2002 and for the periods from November 23, 2000 to June 29, 2001 and

July 1, 2000 to November 22, 2000 was $8 million, $8 million, $6 million and $4 million, respectively. The Company subleases a portion of its

facilities that it considers to be in excess of current requirements. Total future lease income to be recognized for the Company’s existing

subleases is approximately $21 million.

Capital Expenditures —The Company’s commitments for construction of manufacturing facilities and equipment approximated $147

million at June 27, 2003.

92

Operating

Leases

(in millions)

2004

$

19

2005

15

2006

18

2007

7

2008

8

After 2008

128

$

195