Seagate 2002 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

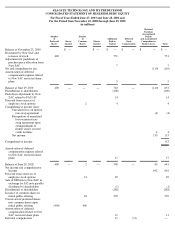

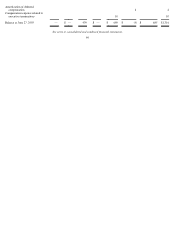

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

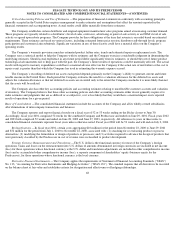

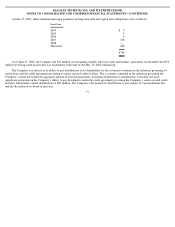

Fair Value Disclosures —The carrying value of cash and cash equivalents approximates fair value. The fair values of short-term

investments, notes, marketable equity securities, debentures and interest rate swap agreements are estimated based on quoted market prices.

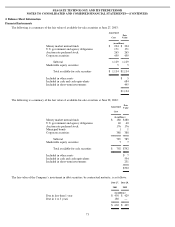

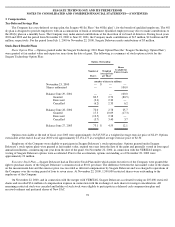

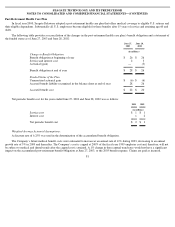

The carrying values and fair values of the Company’s financial instruments are as follows:

Derivative Financial Instruments —The Company may enter into foreign currency forward exchange and option contracts to manage

exposure related to certain foreign currency commitments, certain foreign currency denominated balance sheet positions and anticipated

foreign currency denominated expenditures. The Company does not enter into derivative financial instruments for trading purposes. During

fiscal years 2003 and 2002, the period from November 23, 2000 to June 29, 2001 and the period from July 1, 2000 to November 22, 2000, the

Company did not have any foreign currency forward exchange or purchased currency option contracts.

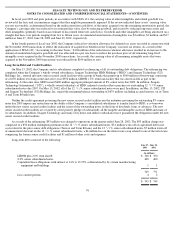

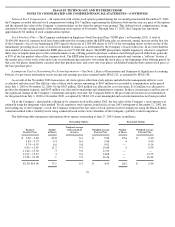

In December 2000, the Company entered into interest rate swap agreements to hedge a portion of its floating rate debt as required under

the terms of the loan agreement. On May 13, 2002, in connection with the repayment of the former senior secured credit facilities, a loss of $4

million under the swap agreement was recognized and included as an element of the debt refinancing charges. The swap agreement was then

redesignated as a hedge for a portion of the floating rate debt under the new senior secured credit facilities. The interest rate swap agreement

expired in November 2002. The Company does not enter into swap agreements for trading purposes.

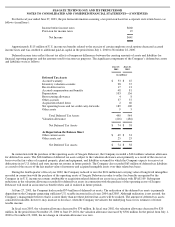

The Company does transact business in various foreign countries and its primary foreign currency cash flows are in emerging market

countries in Asia and in some European countries. Net foreign currency transaction gains and losses included in the determination of net

income (loss) were a gain of $1 million for fiscal year 2003, a loss of $8 million for fiscal year 2002, and gains of $3 million and $1 million for

the period from November 23, 2000 to June 29, 2001 and July 1, 2000 to November 22, 2000, respectively.

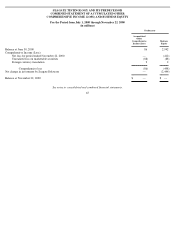

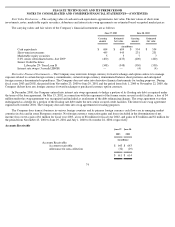

Accounts Receivable

June 27, 2003

June 28, 2002

Carrying

amount

Estimated

fair value

Carrying

amount

Estimated

fair value

(in millions)

Cash equivalents

$

684

$

684

$

554

$

554

Short

-

term investments

445

445

231

231

Marketable equity securities

5

5

7

7

8.0% senior subordinated notes, due 2009

(400

)

(433

)

(400

)

(400

)

Senior Credit Facilities:

Libor plus 2% Term Loan B

(348

)

(348

)

(350

)

(350

)

Interest rate swaps (3 month LIBOR)

—

—

(

4

)

(4

)

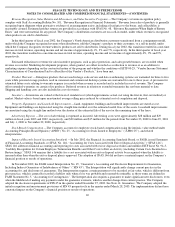

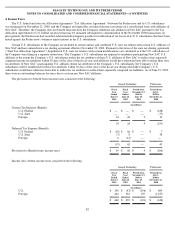

74

June 27,

2003

June 28,

2002

(in millions)

Accounts Receivable:

Accounts receivable

$

643

$

643

Allowance for non

-

collection

(32

)

(29

)

$

611

$

614