Seagate 2002 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

14. Guarantees

Intellectual Property Indemnification Obligations

The Company has entered into agreements with customers and suppliers that include limited intellectual property indemnification

obligations that are customary in the industry. These guarantees generally require the Company to compensate the other party for certain

damages and costs incurred as a result of third party intellectual property claims arising from these transactions. The nature of the intellectual

property indemnification obligations prevents the Company from making a reasonable estimate of the maximum potential amount it could be

required to pay to its customers and suppliers. Historically, the Company has not made any significant indemnification payments under such

agreements and no amount has been accrued in the accompanying consolidated financial statements with respect to these indemnification

obligations.

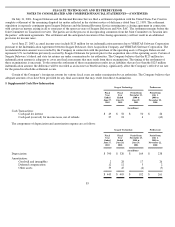

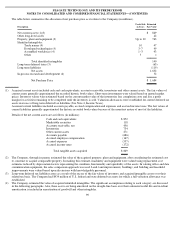

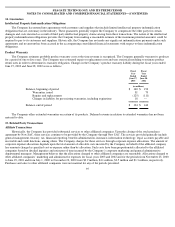

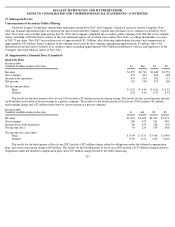

Product Warranty

The Company estimates probable product warranty costs at the time revenue is recognized. The Company generally warrants its products

for a period of one to five years. The Company uses estimated repair or replacement costs and uses statistical modeling to estimate product

return rates in order to determine its warranty obligation. Changes in the Company’s product warranty liability during the fiscal years ended

June 27, 2003 and June 28, 2002 were as follows:

The Company offers extended warranties on certain of its products. Deferred revenue in relation to extended warranties has not been

material to date.

15. Related Party Transactions

Fiscal

Year

Ended

June 27,

2003

Fiscal

Year

Ended

June 28,

2002

(in millions)

Balance, beginning of period

$

160

$

192

Warranties issued

81

79

Repairs and replacements

(125

)

(111

)

Changes in liability for pre

-

existing warranties, including expirations

18

—

Balance, end of period

$

134

$

160

Affiliate Transactions

Historically, the Company has provided substantial services to other affiliated companies. Upon the closing of the stock purchase

agreement by New SAC, these services continue to be provided by the Company through New SAC. The services provided generally include

general management, treasury, tax, financial reporting, benefits administration, insurance, information technology, legal, accounts payable and

receivable and credit functions, among others. The Company charges for these services through corporate expense allocations. The amount of

corporate expense allocations depends upon the total amount of allocable costs incurred by the Company on behalf of the affiliated company

less amounts charged as specified cost or expense rather than by allocation. Such costs have been proportionately allocated to the affiliated

companies based on detailed inquiries and estimates of time incurred by the Company’s corporate marketing and general administrative

departmental managers. Management believes that the allocations charged to other affiliated companies are reasonable. Allocations charged to

other affiliated companies’ marketing and administrative expenses for fiscal years 2003 and 2002 and for the periods from November 23, 2000

to June 29, 2001 and from July 1, 2000 to November 22, 2000 were $3.9 million, $4.1 million, $3.5 million and $1.3 million, respectively.

Purchases and sales to other affiliated companies were not material for any of the periods presented.

95