Seagate 2002 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

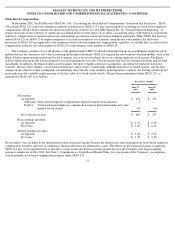

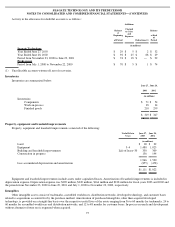

In fiscal year 2002 and prior periods, in accordance with SFAS 121, the carrying value of other intangibles and related goodwill was

reviewed if the facts and circumstances suggest that they might be permanently impaired. If the review indicated these assets’ carrying value

was not recoverable, as determined based on the undiscounted net cash flows of the entity acquired over the remaining amortization period, the

Company’s carrying value was reduced to its estimated fair value, first by reducing goodwill, and second by reducing long-term assets and

other intangibles (generally based on an estimate of discounted future net cash flows). Goodwill and other intangibles are being amortized on a

straight-line basis over periods ranging from two to fifteen years. Accumulated amortization of intangibles was $3 million, $1 million, and $17

million at June 27, 2003, June 28, 2002 and June 29, 2001, respectively.

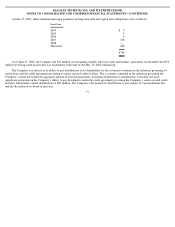

In the fourth quarter of fiscal year 2002, the Company reduced its valuation allowance for deferred tax assets recorded in connection with

the November 2000 transactions to reflect the realization of acquired tax benefits in the Company’s income tax returns. As a result of the

application of SFAS 109, “Accounting for Income Taxes,” $104 million of the reduction in valuation allowance resulted in an increase to the

amount of unamortized negative goodwill and was allocated on a pro rata basis to reduce the purchase price of all remaining long-lived

intangible assets acquired in the November 2000 transactions. As a result, the carrying value of all remaining intangible assets that were

acquired in the November 2000 transactions was reduced from $104 million to zero.

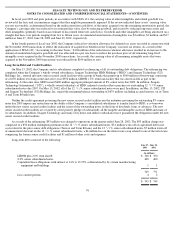

Long-Term Debt and Credit Facilities

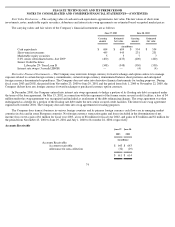

On May 13, 2002, the Company and its subsidiaries completed a refinancing of all its outstanding debt obligations. The refinancing was

completed when the Company’s wholly-owned subsidiaries, Seagate Technology HDD Holdings (“HDD”) and Seagate Technology (US)

Holdings, Inc., entered into new senior secured credit facilities with a group of banks that permit up to $500 million of borrowings consisting

of a $150 million revolving credit and a five-year $350 million, LIBOR + 2% term loan facility that was drawn in full as part of the

refinancing. At the same time, HDD issued $400 million aggregate principal amount of 8% senior notes due 2009. In addition, Seagate

Technology International (“STI”), a wholly-owned subsidiary of HDD, initiated a tender offer to purchase its outstanding 12

1

/

2

% senior

subordinated notes due 2007. On May 13, 2002, all of the 12

1

/

2

% senior subordinated notes were paid. In addition, on May 13, 2002, STI

and Seagate Technology (US) Holdings, Inc. repaid the remaining balance outstanding of $679 million, including accrued interest, on its Term

A and Term B bank loans.

Neither the credit agreement governing the new senior secured credit facilities nor the indenture governing the outstanding 8% senior

notes due 2009 impose any restrictions on the ability of the Company’s consolidated subsidiaries to transfer funds to HDD, a co-borrower

under the new senior secured credit facilities and the issuer of the outstanding notes, in the form of dividends, loans or advances. The new

senior secured credit facilities are secured by a first priority pledge of substantially all the tangible and intangible assets of HDD and many of

its subsidiaries. In addition, Seagate Technology and many of its direct and indirect subsidiaries have guaranteed the obligations under the new

senior secured credit facilities.

As a result of the refinancing, $93 million was charged to operations in the quarter ended June 28, 2002. The $93 million charge was

comprised of a $50 million redemption premium on the 12

1

/

2

% senior subordinated notes, $31 million write-off of capitalized debt issue

costs related to the prior senior debt obligations (Term A and Term B loans) and the 12

1

/

2

% senior subordinated notes, $7 million write off

of unamortized discount on the 12

1

/

2

% senior subordinated notes, a $4 million loss on the interest rate swap related to one of the term loans

comprising the former senior credit facilities and $1 million of other costs and expenses.

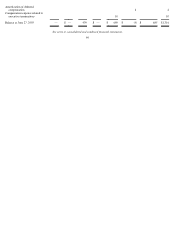

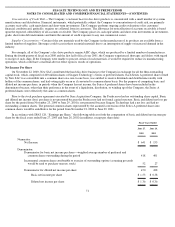

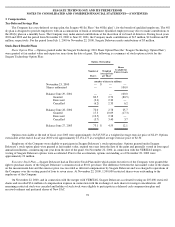

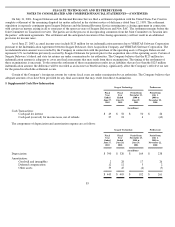

Long-term debt consisted of the following:

76

June 27,

2003

June 28,

2002

(in millions)

LIBOR plus 2.0% term loan B

$

348

$

350

8.0% senior subordinated notes

400

400

Capitalized lease obligations with interest at 14% to 19.25% collateralized by by certain manufacturing

equipment and buildings

1

1

749

751

Less current portion

4

2

$

745

$

749