Seagate 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

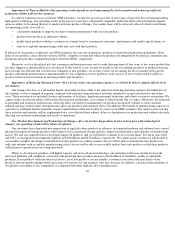

The credit agreement that governs our senior secured credit facilities contains covenants that Seagate Technology HDD Holdings, our

wholly-owned subsidiary that operates our rigid disc drive business, must satisfy in order to remain in compliance with the agreement. These

covenants require Seagate Technology HDD Holdings, among other things, to maintain the following ratios: (1) an interest expense coverage

ratio for any period of four consecutive fiscal quarters of at least 2.50 to 1.00; (2) a fixed charge coverage ratio for any four consecutive fiscal

quarters of at least (a) 1.25 to 1.00 for the period from June 30, 2002 to June 29, 2003 and (b) 1.50 to 1.00 for any period after June 30, 2003;

and (3) a net leverage ratio of not more than 1.50 to 1.00 as of the end of any fiscal quarter commencing on or after June 30, 2002. We are

currently in compliance with all of these covenants, including the financial ratios that we are required to maintain.

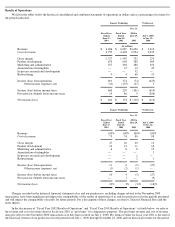

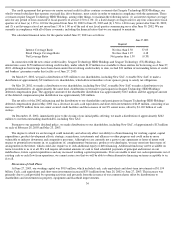

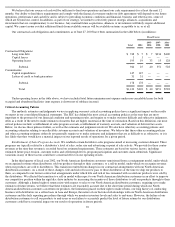

The calculated financial ratios for the quarter ended June 27, 2003 are as follows:

In connection with the new senior credit facility, Seagate Technology HDD Holdings and Seagate Technology (US) Holdings, Inc.

entered into a new $150 million revolving credit facility, under which $119 million was available to these entities for borrowing as of June 27,

2003. Although no borrowings have been drawn under this revolving credit facility to date, we had $31 million of outstanding letters of credit

and bankers’ guarantees under this facility as of June 27, 2003.

On March 19, 2002, we paid a distribution of $33 million to our shareholders, including New SAC, to enable New SAC to make a

distribution of approximately $33 million to its shareholders, which allowed members of our sponsor group to satisfy tax obligations.

On May 20, 2002, we made a distribution to our shareholders, including New SAC, to enable New SAC to make a distribution to its

preferred shareholders. At approximately the same time, distributions were made to participants in Seagate Technology HDD Holdings’

deferred compensation plan. The aggregate amount of the shareholder distribution was approximately $167 million and the aggregate amount

of the deferred compensation plan distribution was approximately $32 million.

The net effect of the 2002 refinancing and the distribution to our shareholders and participants in Seagate Technology HDD Holdings’

deferred compensation plan in May 2002 was a decrease in cash, cash equivalents and short-term investments of $419 million, consisting of an

increase of $750 million from our senior secured credit facilities and the issuance of our 8% senior notes, offset by $1.169 billion of cash

outlays.

On December 13, 2002, immediately prior to the closing of our initial public offering, we made a distribution of approximately $262

million to our then-outstanding shareholders, including New SAC.

Pursuant to our quarterly dividend policy, we made distributions to our shareholders, including New SAC, of approximately $13 million

on each of February 28, 2003 and May 23, 2003.

The degree to which we are leveraged could materially and adversely affect our ability to obtain financing for working capital, capital

expenditures, product development efforts, strategic acquisitions, investments and alliances or other purposes and could make us more

vulnerable to industry downturns and competitive pressures. Although we are currently not a party to any agreement or letter of intent with

respect to potential investments in, or acquisitions of, complementary businesses, products or technologies, we may enter into these types of

arrangements in the future, which could also require us to seek additional equity or debt financing. Additional funds may not be available on

terms favorable to us or at all. We will require substantial amounts of cash to fund scheduled payments of principal and interest on our

indebtedness, future capital expenditures and any increased working capital requirements. If we are unable to meet our cash requirements out of

existing cash or cash flow from operations, we cannot assure you that we will be able to obtain alternative financing on terms acceptable to us,

if at all.

Discussion of Cash Flows

Required

June 27, 2003

Interest Coverage Ratio

Not less than 2.50

37.03

Fixed Charge Coverage Ratio

Not less than 1.25

4.18

Net Leverage Ratio

Not greater than 1.50

(0.39

)

At June 27, 2003, our working capital was $919 million, which included cash, cash equivalents and short-term investments of $1.194

billion. Cash, cash equivalents and short-term investments increased $351 million from June 28, 2002 to June 27, 2003. This increase was

primarily due to cash provided by operating activities and proceeds from the issuance of our common shares offset by distributions to

shareholders and investments in property, equipment and leasehold improvements.

36