Seagate 2002 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

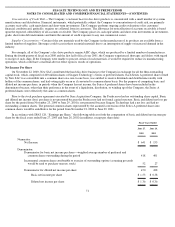

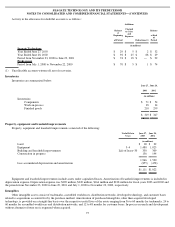

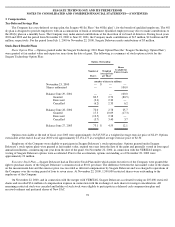

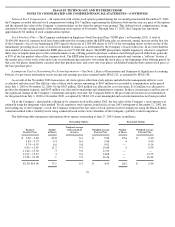

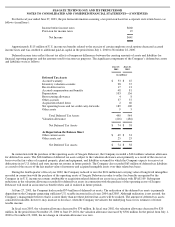

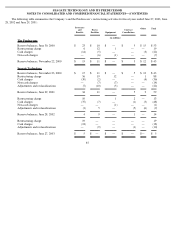

The fair value of the Company’s stock options granted to employees for fiscal years 2003 and 2002 was estimated assuming no expected

dividends (for periods prior to December 27, 2002) and the following weighted average assumptions:

The Company’s initial public offering of its common shares was completed on December 13, 2002. The weighted average fair value of

stock options granted under the Seagate Technology Option plan was $4.80 and $0.95 for fiscal years 2003 and 2002, respectively. The

weighted average fair value of stock options granted under the ESPP plan was $3.31 for fiscal year 2003.

Deferred Compensation Plan

Post-IPO

2003

Pre-IPO

2003

2002

Option Plan Shares

Expected life (in years)

3.0

3.0

10.0

Risk

-

free interest rate

2.1

–

3.0%

2.1

–

3.0%

4.5%

Volatility

0.83

Minimum

Minimum

Expected dividend

0.71

–

1.2%

—

—

ESPP Plan Shares

Expected life (in years)

0.5

–

1.0

—

—

Risk

-

free interest rate

1.2

–

1.3%

—

—

Volatility

0.74

–

0.91

—

—

Expected dividend

1.2%

—

—

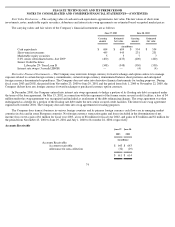

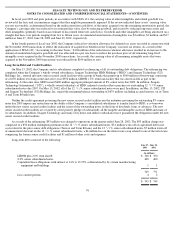

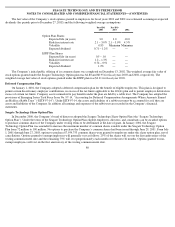

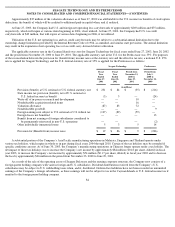

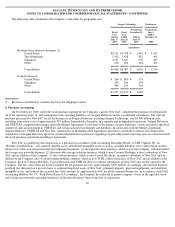

On January 1, 2001, the Company adopted a deferred compensation plan for the benefit of eligible employees. This plan is designed to

permit certain discretionary employer contributions, in excess of the tax limits applicable to the 401(k) plan and to permit employee deferrals in

excess of certain tax limits. Company assets earmarked to pay benefits under the plan are held by a rabbi trust. The Company has adopted the

provisions of Emerging Issues Task Force Issue No. 97-14, “Accounting for Deferred Compensation Arrangements Where Amounts Earned

are Held in a Rabbi Trust” (“EITF 97-14”). Under EITF 97-14, the assets and liabilities of a rabbi trust must be accounted for as if they are

assets and liabilities of the Company. In addition all earnings and expenses of the rabbi trust are recorded in the Company’s financial

statements.

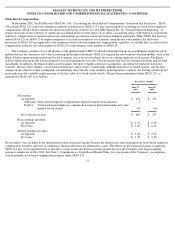

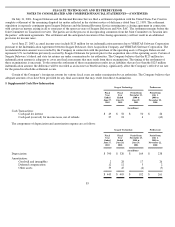

Seagate Technology Share Option Plan

In December 2000, the Company’s board of directors adopted the Seagate Technology Share Option Plan (the “Seagate Technology

Option Plan”). Under the terms of the Seagate Technology Option Plan eligible employees, directors, and consultants can be awarded options

to purchase common shares of the Company under vesting terms to be determined at the date of grant. In January 2002, the Seagate

Technology Option Plan was amended to increase the maximum number of common shares issuable under the Seagate Technology Option

Plan from 72 million to 100 million. No options to purchase the Company’s common shares had been issued through June 29, 2001. From July

1, 2001 through June 27, 2003, options to purchase 87,954,753 common shares were granted to employees under this share option plan, net of

cancellations. Options granted to exempt employees will generally vest as follows: 25% of the shares will vest on the first anniversary of the

vesting commencement date and the remaining 75% will vest proportionately each month over the next 36 months. Options granted to non-

exempt employees will vest on the first anniversary of the vesting commencement date.

80