Seagate 2002 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

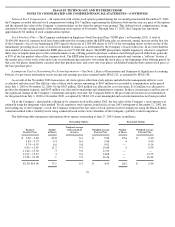

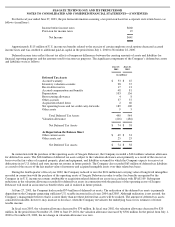

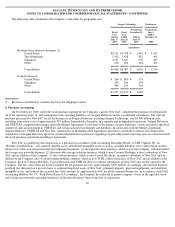

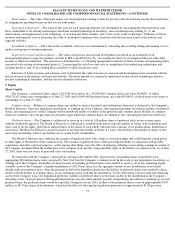

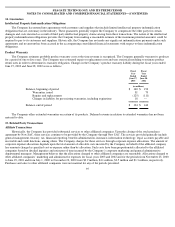

7. Business Segment and Geographic Information

Prior to the Company’

s sale of XIOtech Corporation to New SAC on November 4, 2002, the Company had two operating segments: rigid

disc drives and storage area networks, however, only the rigid disc drive business was a reportable segment. See Note 12, Sale of XIOtech

Corporation. The operating results for XIOtech are included in the Company’s consolidated results of operations through the date that XIOtech

was sold to New SAC and are included in the “other” category below. The Company has identified its Chief Executive Officer, or CEO, as the

Chief Operating Decision Maker. Gross profit from operations is defined as revenue less cost of revenue.

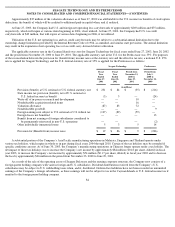

In fiscal year 2003, Hewlett-Packard Corporation accounted for more than 10% of consolidated revenue for a total of $1.143 billion. In

fiscal year 2002, on a combined basis Compaq Computer Corporation and Hewlett-Packard Corporation (Hewlett-Packard Corporation

acquired Compaq Computer Corporation in May 2002) accounted for more than 10% of consolidated revenue for a total of $1.190 billion. For

the period from November 23, 2000 to June 29, 2001, Compaq Computer Corporation and EMC Corporation each accounted for more than

10% of consolidated revenue for a total of $527 million and $434 million, respectively. For the period from July 1, 2000 to November 22,

2000, Compaq Computer Corporation and EMC Corporation each accounted for more than 10% of combined revenue for a total of $422

million and $328 million, respectively.

Long-lived assets consist of property, equipment and leasehold improvements, capital leases, equity investments, goodwill and other

intangibles, and other non-current assets as recorded by the Company’s operations in each area.

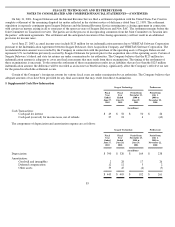

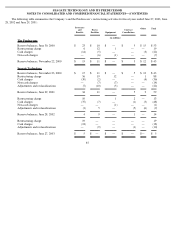

The following tables summarize the Company’s operations by business segment:

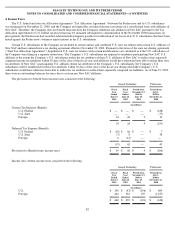

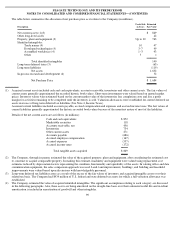

On a separate basis, in conformity with accounting principles generally accepted in the United States, XIOtech had net losses of $9

million, $51 million, $50 million and $24 million in fiscal year 2003, fiscal year 2002, the period from November 23, 2000 to June 29, 2001

and the period from July, 2000 to November 22, 2000.

88

Seagate Technology

Predecessor

Fiscal

Year

Ended

June 27,

2003

Fiscal

Year

Ended

June 28,

2002

Period from

November 23,

2000 to

June 29,

2001

Period from

July 1,

2000 to

November 22,

2000

(in millions)

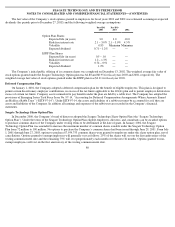

Revenue and Gross Profit

Revenue:

Rigid Disc Drives

$

6,464

$

6,023

$

3,626

$

2,292

Other

24

74

39

21

Eliminations

(2

)

(10

)

(9

)

(3

)

Consolidated

$

6,486

$

6,087

$

3,656

$

2,310

Gross Profit:

Rigid Disc Drives

$

1,715

$

1,558

$

712

$

264

Other

12

35

20

11

Consolidated

$

1,727

$

1,593

$

732

$

275

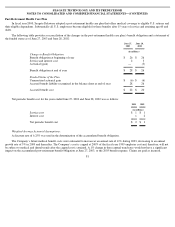

Total Assets

Total Assets:

Rigid Disc Drives

$

3,522

$

3,103

Other

—

43

Operating Segments

3,522

3,146

Eliminations

(5

)

(51

)

Consolidated

$

3,517

$

3,095