Seagate 2002 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

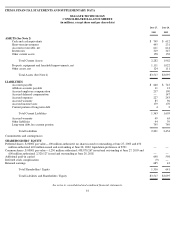

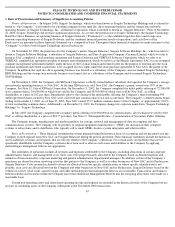

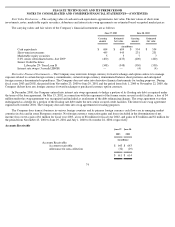

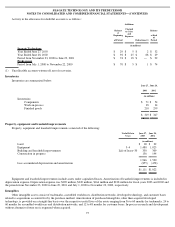

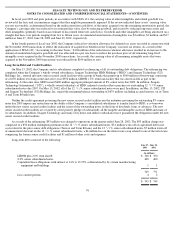

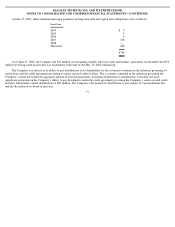

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS

1. Basis of Presentation and Summary of Significant Accounting Policies

Nature of Operations —In August 2000, Seagate Technology, which was then known as Seagate Technology Holdings and is referred to

herein as “the Company,” was formed to be a holding company for the rigid disc drive operating business and the storage area networks

operating business of Seagate Technology, Inc., a Delaware corporation, which is referred to herein as “Seagate Delaware.” Prior to November

22, 2000, Seagate Technology did not have significant operations. As a result, the predecessor to Seagate Technology, the Seagate Technology

Hard Disc Drive Business, an operating business of Seagate Delaware (“Predecessor”), is the combined rigid disc drive and storage area

networks operating businesses of Seagate Delaware, and the combined financial position, results of operations, and cash flows of the

Predecessor are presented in these financial statements on a comparative basis. Throughout these financial statements we make reference to the

“Company” to refer to both Seagate Technology and its Predecessor.

On November 22, 2000, the predecessor to the Company’s parent, Seagate Delaware, Seagate Software Holdings, Inc., which we refer to

herein as Seagate Software Holdings, a subsidiary of Seagate Delaware, and Suez Acquisition Company (Cayman) Limited, which we refer to

herein as SAC, completed a stock purchase agreement and Seagate Delaware and VERITAS Software Corporation, which we refer to as

VERITAS, completed an agreement and plan of merger and reorganization, which we refer to as the Merger Agreement. SAC was an exempted

company incorporated with limited liability under the laws of the Cayman Islands and formed solely for the purpose of entering into the stock

purchase agreement and related acquisitions. SAC assigned all of its rights under the stock purchase agreement to New SAC, the parent of the

Company. In addition, the rigid disc drive operating business was formed as a subsidiary of the Company, and was named Seagate Technology

HDD Holdings and the storage area networks business was formed also as a subsidiary of the Company and was named Seagate Technology

SAN Holdings.

On November 4, 2002, the Company sold XIOtech Corporation, a wholly-owned indirect subsidiary that operated the Company’s storage

area networks operating business, to New SAC. At the time XIOtech was sold, New SAC, the Company’s parent, owned over 99% of the

Company. See Note 12, Sale of XIOtech Corporation. On December 13, 2002, the Company completed the initial public offering of 72,500,000

of its common shares, 24,000,000 of which were sold by the Company and 48,500,000 of which were sold by New SAC, as selling

shareholder, at a price of $12 per share. Immediately prior to the closing of the initial public offering, the Company’s then-outstanding 400

million preferred shares owned by New SAC were converted into common shares on a one-to-one basis. The Company’

s common shares began

trading on December 11, 2002. As of June 27, 2003, New SAC owned 351.5 million common shares of the Company, or approximately 80.1%

of total outstanding common shares. Additionally, on December 13, 2002, the Company changed its corporate name from “

Seagate Technology

Holdings” to “Seagate Technology.”

In July 2003, the Company completed the secondary public offering of 69,000,000 of its common shares, all of which were sold by New

SAC, as selling shareholder, at a price of $18.75 per share. See Note 17. Subsequent Events—Consummation of Secondary Public Offering.

The Company designs, manufactures and markets products for storage, retrieval and management of data on computer and data

communications systems. The Company sells its products to original equipment manufacturers (“OEM”) for inclusion in their computer

systems or subsystems, and to distributors who typically sell to small OEMs, dealers, system integrators and other resellers.

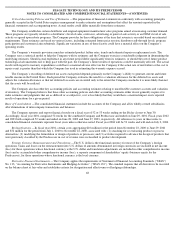

Basis of Presentation— These financial statements have been prepared using the historical basis of accounting and are presented as if the

Company existed separate from New SAC and Seagate Delaware during the periods presented. These financial statements include the historical

assets, liabilities, revenues and expenses that are directly related to the Company’s operations. For certain assets and liabilities that are not

specifically identifiable with the Company, estimates have been used to allocate such assets and liabilities to the Company by applying

methodologies management believes are appropriate.

The statements of operations include all revenues and expenses attributable to the Company, including allocations of certain corporate

administration, finance, and management costs. Such costs were proportionately allocated to the Company based on detailed inquiries and

estimates of time incurred by corporate marketing and general administrative departmental managers. In addition, certain of the Company’s

operations are shared locations involving activities that pertain to the Company as well as to other businesses of New SAC and its Predecessor,

Seagate Delaware. Costs incurred in shared locations are allocated based on specific identification, or where specific identification is not

possible, such costs are allocated between the Company and other businesses of New SAC and its Predecessor, Seagate Delaware based on the

volume of activity, head count, square footage, and other methodologies that management believes are reasonable. Transactions and balances

between entities and locations within the Company have been eliminated. Management believes that the foregoing allocations were made on a

reasonable basis.

Certain non-operating assets and related non-operating income and expense are included in the historical results of the Company but are

not part of continuing assets of the Company subsequent to the November 2000 transactions.

67