Seagate 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

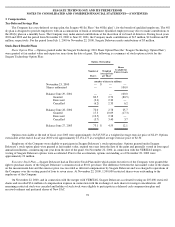

Concentration of Credit Risk —The Company’s customer base for disc drive products is concentrated with a small number of systems

manufacturers and distributors. Financial instruments, which potentially subject the Company to concentrations of credit risk, are primarily

accounts receivable, cash equivalents and short-term investments. The Company performs ongoing credit evaluations of its customers’

financial condition and, generally, requires no collateral from its customers. The allowance for noncollection of accounts receivable is based

upon the expected collectibility of all accounts receivable. The Company places its cash equivalents and short-term investments in investment-

grade, short-term debt instruments and limits the amount of credit exposure to any one commercial issuer.

Supplier Concentration —Certain of the raw materials used by the Company in the manufacture of its products are available from a

limited number of suppliers. Shortages could occur in these essential materials due to an interruption of supply or increased demand in the

industry.

For example, all of the Company’s disc drive products require ASIC chips, which are produced by a limited number of manufacturers.

During the fourth quarter of fiscal year 2000 and the first half of fiscal year 2001, the Company experienced shortages and delays with regard

to receipt of such chips. If the Company were unable to procure certain of such materials, it would be required to reduce its manufacturing

operations, which could have a material adverse effect upon its results of operations.

Net Income Per Share

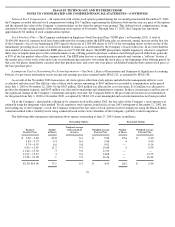

On November 22, 2000, New SAC contributed the hard disc drive business to the Company in exchange for all the then-outstanding

capital stock, which comprised of 400 million shares of Seagate Technology’s Series A preferred shares. Each Series A preferred share owned

by New SAC was convertible into a common share on a one-to-one basis, was entitled to receive dividends and distributions ratably with

holders of the common shares, and had voting rights on an as if converted to common shares basis. For the purpose of computing basic and

diluted net income per share, in periods when the Company has net income, the Series A preferred shares have been included in the

denominator because, other than their preference in the event of a liquidation, dissolution, or winding up of the Company, the Series A

preferred shares were effectively the same as common shares.

Prior to the stock purchase agreement executed by Suez Acquisition Company, the Predecessor had no outstanding share capital. Basic

and diluted net income (loss) per share is not presented because the Predecessor had no formal capital structure. Basic and diluted net loss per

share for the period from November 23, 2000 to June 29, 2001 is not presented because Seagate Technology had a net loss and had no

outstanding common shares. The potential common shares represented by the assumed conversion of the Series A preferred shares into

common shares would be antidilutive for the period from November 23, 2000 to June 29, 2001.

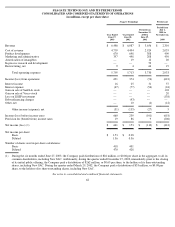

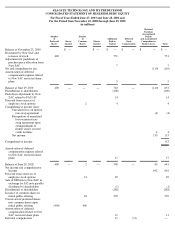

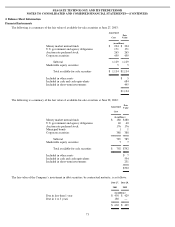

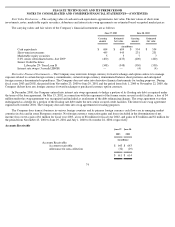

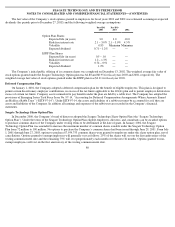

In accordance with SFAS 128, “Earnings per Share,” the following table sets forth the computation of basic and diluted net income per

share for the fiscal years ended June 27, 2003 and June 28, 2002 (in millions, except per share data):

71

Fiscal Years Ended

June 27,

2003

June 28,

2002

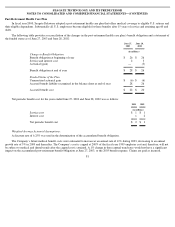

Numerator:

Net Income

$

641

$

153

Denominator:

Denominator for basic net income per share—weighted average number of preferred and

common shares outstanding during the period

418

401

Incremental common shares attributable to exercise of outstanding options (assuming proceeds

would be used to purchase treasury stock)

52

27

Denominator for diluted net income per share

470

428

Basic net income per share

$

1.53

$

0.38

Diluted net income per share

$

1.36

$

0.36