Seagate 2002 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

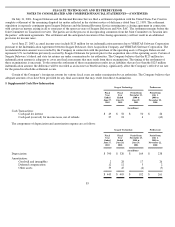

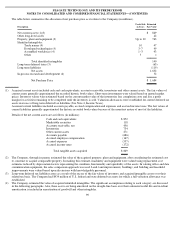

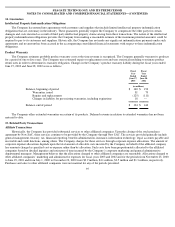

6. Restructuring Costs

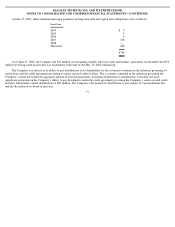

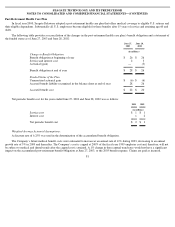

During fiscal year 2003, the Company recorded $19 million in restructuring charges. The Company also reduced a restructuring accrual

previously recorded by its predecessor in fiscal year 1998 by $10 million due to a change in estimated lease obligations. These combined

actions resulted in a net restructuring charge of $9 million for fiscal year 2003.

Of the $19 million, $17 million was incurred in the quarter ended September 27, 2002 as a result of a restructuring plan, which the

Company refers to as the fiscal year 2003 restructuring plan, established to continue the alignment of the Company’s global workforce and

manufacturing capacity with existing and anticipated future market requirements, primarily in its Far East operations. The restructuring charge

was comprised of employee termination costs relating to a reduction in its workforce of approximately 3,750 employees, 3,410 of whom had

been terminated as of June 27, 2003. The fiscal year 2003 restructuring plan was substantially complete at June 27, 2003.

The remaining $2 million restructuring charge was incurred in the quarter ended June 27, 2003 and was comprised of employee

termination costs relating to a workforce reduction of approximately 686 employees in the Company’

s Thailand operations. These restructuring

activities were completed in July 2003.

During fiscal year 2002, the Company recorded $13 million in restructuring charges and reversed $9 million of restructuring charges

recorded in prior fiscal years resulting in a net restructuring charge of $4 million. The restructuring plan implemented in fiscal year 2002 (the

“fiscal year 2002 restructuring plan”) was established to align the Company’s global workforce and manufacturing capacity with existing and

anticipated future market requirements, primarily in its IT operations and in its Far East operations in China. The restructuring charges were

comprised of $10 million for employee termination costs, $2 million for contract cancellations and $1 million for the write-off of excess

manufacturing equipment. The fiscal year 2002 restructuring plan was substantially complete prior to the end of the first quarter of fiscal year

2003.

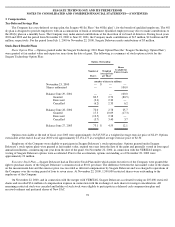

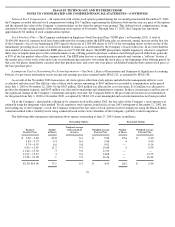

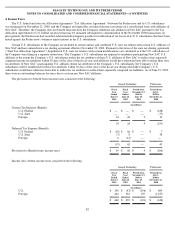

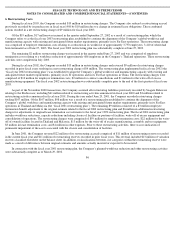

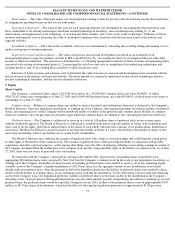

As part of the November 2000 transactions, the Company assumed all restructuring liabilities previously recorded by Seagate Delaware

relating to the Predecessor, including $41 million related to restructuring activities announced in fiscal year 2000 and $3 million related to

restructuring activities announced in fiscal year 2001. During the year ended June 29, 2001, the Company recorded restructuring charges

totaling $107 million. Of the $107 million, $98 million was a result of a restructuring plan established to continue the alignment of the

Company’s global workforce and manufacturing capacity with existing and anticipated future market requirements, primarily in its Far East

operations in Thailand and Malaysia (the “fiscal 2001 restructuring plan”). The remaining $9 million consisted of a $3 million employee

termination benefit adjustment to the original estimate related to the fiscal 2000 restructuring plan and $6 million in additional restructuring

charges for adjustments to original lease termination cost estimates to the fiscal year 1998 restructuring plan. The fiscal 2001 restructuring plan

includes workforce reductions, capacity reductions including closure of facilities or portions of facilities, write-off of excess equipment and

consolidation of operations. The restructuring charges were comprised of $59 million for employee termination costs; $22 million for the write-

off of owned facilities located in Thailand and Malaysia; $13 million for the write-off of excess manufacturing, assembly and test equipment;

$3 million in lease termination costs; and $1 million in other expenses. Prior to these restructuring activities, there was no indication of

permanent impairment of the assets associated with the closure and consolidation of facilities.

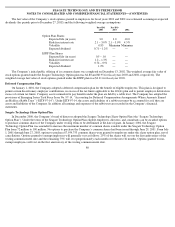

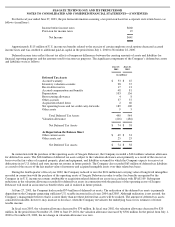

In June 2001, the Company reversed $22 million of its restructuring accruals comprised of $11 million of restructuring reserves recorded

in the current fiscal year and $11 million of restructuring reserves recorded in prior fiscal years. This reversal included $13 million of valuation

reserves classified elsewhere on the balance sheet. In addition, reclassifications between cost categories within the restructuring reserve were

made as a result of differences between original estimates and amounts actually incurred or expected to be incurred.

In connection with the fiscal year 2001 restructuring plan, the Company’s planned workforce reduction and other restructuring activities

were substantially complete as of March 29, 2002.

86