Seagate 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

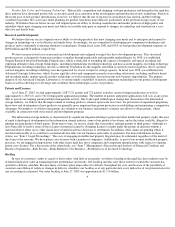

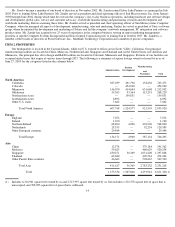

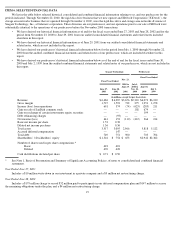

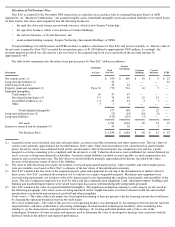

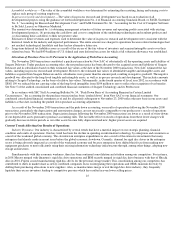

ITEM 6. SELECTED FINANCIAL DATA

We list in the table below selected historical consolidated and combined financial information relating to us, and our predecessor for the

periods indicated. Through November 22, 2000, the rigid disc drive business that we now operate and XIOtech Corporation (“XIOtech”), the

storage area networks business that we operated through November 4, 2002, were the rigid disc drive and storage area networks divisions of

Seagate Technology, Inc., a Delaware corporation. Those divisions are our predecessor, and our operations prior to our sale of XIOtech were

substantially identical to the operations of our predecessor before the November 2000 transactions.

•

We have derived our historical financial information as of and for the fiscal years ended June 27, 2003 and June 28, 2002 and for the

period from November 23, 2000 to June 29, 2001 from our audited consolidated financial statements and related notes included

elsewhere in this report.

•

We have derived our historical financial information as of June 29, 2001 from our audited consolidated financial statements and

related notes, which are not included in this report.

•

We have derived our predecessor’s historical financial information below for the period from July 1, 2000 through November 22,

2000 from the audited combined financial statements and related notes of our predecessor, which are included elsewhere in this

report.

Year Ended June 27, 2003

•

We have derived our predecessor’s historical financial information below as of the end of and for the fiscal years ended June 30,

2000 and July 2, 1999 from the audited combined financial statements and related notes of our predecessor, which are not included in

this report.

Seagate Technology

Predecessor

Fiscal Year Ended

Nov. 23,

2000 to

June 29,

2001

July 1,

2000 to

Nov. 22,

2000

Fiscal Year Ended

June 27,

2003

June 28,

2002

June 30,

2000

July 2,

1999

(in millions, except for per share data)

Revenue

$

6,486

$

6,087

$

3,656

$

2,310

$

6,073

$

6,180

Gross margin

1,727

1,593

732

275

1,251

1,278

Income (loss) from operations

691

374

(74

)

(623

)

(285

)

211

Gain on sale of SanDisk common stock

—

—

—

102

679

—

Gain on exchange of certain investments equity securities

—

—

—

—

199

—

Debt refinancing charges

—

(

93

)

—

—

—

—

Net income (loss)

641

153

(110

)

(412

)

366

214

Basic net income per share

1.53

0.38

Diluted net income per share

1.36

0.36

Total assets

3,517

3,095

2,966

5,818

5,122

Accrued deferred compensation

—

147

—

—

—

Total debt

749

751

900

703

704

Shareholders

’

/

Stockholders

’

equity

$

1,316

$

754

$

653

$

2,942

$

2,362

Number of shares used in per share computations:*

Basic

418

401

Diluted

470

428

Cash distributions declared per share

$

0.71

$

0.50

*

See Note 1, Basis of Presentation and Summary of Significant Accounting Policies, of notes to consolidated and combined financial

statements.

Includes a $10 million write-down in our investment in a private company and a $9 million net restructuring charge.

Year Ended June 28, 2002

Includes a $179 million charge to record $32 million paid to participants in our deferred compensation plan and $147 million to accrue

the remaining obligations under the plan, and a $4 million net restructuring charge.

19