Seagate 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SEAGATE TECHNOLOGY AND ITS PREDECESSOR

NOTES TO CONSOLIDATED AND COMBINED FINANCIAL STATEMENTS—(CONTINUED)

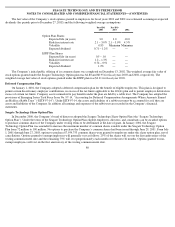

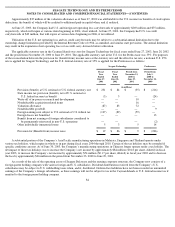

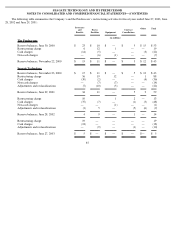

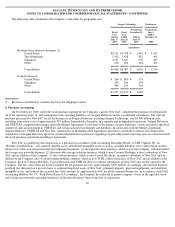

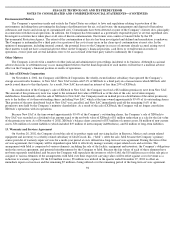

The following table summarizes the Company’s operations by geographic area:

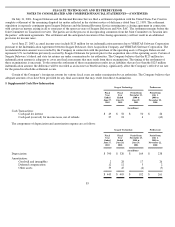

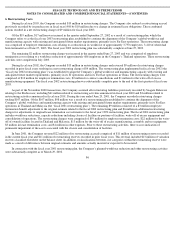

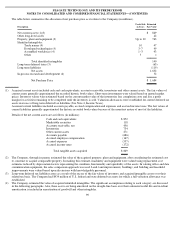

8. Purchase Accounting

Seagate Technology

Predecessor

Fiscal

Year

Ended

June 27,

2003

Fiscal

Year

Ended

June 28,

2002

Period from

November 23,

2000 to

June 29,

2001

Period from

July 1,

2000 to

November 22,

2000

(in millions)

Revenue from external customers (1):

United States

$

2,151

$

2,398

$

1,441

$

1,103

The Netherlands

1,562

1,438

881

461

Singapore

2,137

1,627

970

445

Other

636

624

364

301

Consolidated

$

6,486

$

6,087

$

3,656

$

2,310

Long

-

lived assets:

United States

$

504

$

805

$

524

Singapore

287

204

194

Other

444

124

310

Consolidated

$

1,235

$

1,133

$

1,028

(1)

Revenue is attributed to countries based on the shipping location.

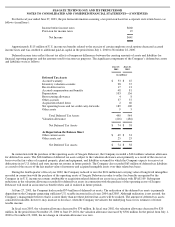

On November 22, 2000, under the stock purchase agreement, the Company’s parent, New SAC completed the purchase of substantially

all of the operating assets of, and assumption of the operating liabilities of, Seagate Delaware and its consolidated subsidiaries. The total net

purchase price paid by New SAC for all the businesses of Seagate Delaware, including Seagate Technology, was $1.840 billion in cash,

including transaction costs of approximately $25 million. Immediately thereafter, in a separate and independent transaction, Seagate Delaware

and VERITAS completed their merger under the Merger Agreement. At the time of the merger, Seagate Delaware’s assets included a specified

amount of cash, an investment in VERITAS, and certain specified investments and liabilities. In connection with the Merger Agreement,

Seagate Delaware, VERITAS and New SAC entered into an Indemnification Agreement, pursuant to which these entities and certain other

subsidiaries of Seagate Delaware agreed to certain indemnification provisions regarding tax and other matters that may arise in connection with

the stock purchase agreement and Merger Agreement.

New SAC accounted for this transaction as a purchase in accordance with Accounting Principles Board, or APB, Opinion No. 16,

“Business Combinations.” All acquired tangible assets, identifiable intangible assets as well as assumed liabilities were valued based on their

relative fair values and reorganized into the following businesses: (1) the rigid disc drive business, which is now the Company, which included

the storage area networks business, (2) the removable storage solutions business, which is now Certance Holdings, a direct subsidiary of New

SAC and an affiliate of the Company, (3) the software business, which is now Crystal Decisions, an indirect subsidiary of New SAC and an

affiliate of the Company, and (4) an investment holding company, which is now STIH, a direct subsidiary of New SAC and an affiliate of the

Company. Each of Certance Holdings, Crystal Decisions and STIH are direct or indirect subsidiaries of New SAC and are not owned by the

Company. The fair value of the net assets exceeded the net purchase price by approximately $909 million. Accordingly, the resultant negative

goodwill was allocated on a pro rata basis to acquired long-lived assets of New SAC, primarily property, plant and equipment, and identified

intangible assets, and reduced the recorded fair value amounts by approximately 46% for all the acquired businesses. In accordance with Staff

Accounting Bulletin No. 73, “Push Down Basis of Accounting”, the Company has reflected its parent company’s basis in the rigid disc drive

and storage area networks operating businesses in the related balance sheet at the date of acquisition.

89