Seagate 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result of the November 2000 transactions and the ensuing corporate structure, we now consist of a foreign parent holding company

with various U.S. domestic and foreign affiliates. We do not expect to be subject to U.S. federal income taxes on dividends or other earnings

distributions that we may receive from foreign subsidiaries. Dividend distributions by U.S. subsidiaries to Seagate Technology HDD Holdings

may be subject to U.S. withholding taxes, if and when distributed. A substantial portion of our manufacturing operations located in the Far East

currently operate free from tax under various tax holidays, which are scheduled to expire in whole or in part at various dates through 2010.

Because of our foreign ownership structure and subject to potential future increases in our valuation allowance for U.S. deferred tax assets, we

anticipate that our effective tax rate in future periods will generally be less than the U.S. federal statutory rate.

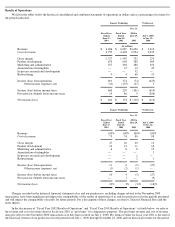

Fiscal Year 2001 Results of Operations

As a result of the closing of the November 2000 transactions, we initiated our operations on November 23, 2000. All results of operations

prior to this date included in this prospectus are the results of operations of our predecessor, the rigid disc drive and storage area networks

business of Seagate Delaware. The following discussion describes the results of operations of our predecessor for the period from July 1, 2000

through November 22, 2000 and our results of operations for the period from November 23, 2000 through June 29, 2001.

Period from July 1, 2000 to November 22, 2000 . During this period our predecessor’

s ability to satisfy customer demand was constrained

by a limited supply of certain electrical components from some of its external suppliers. This resulted in lower than expected revenues during

this period and the shifting of unit shipments that were expected during this period into the subsequent period. As a result of the acceleration of

stock options in connection with the November 2000 transactions, compensation charges were allocated to cost of revenue, product

development expenses, and marketing and administrative expenses in the amounts of $265 million, $116 million and $185 million,

respectively. Additionally, our predecessor incurred $77 million of marketing and administrative expenses related to administrative costs in

connection with the November 2000 transactions. During this period, our predecessor recorded restructuring charges of $19 million to continue

the alignment of its global workforce and manufacturing capacity with existing and anticipated future market requirements and net losses of

$32 million relative to certain of its investments in equity securities.

Seagate Delaware recorded a benefit from income taxes of $206 million in this period. The recorded benefit from income taxes differs

from the benefit from income taxes that would be derived by applying the U.S. federal statutory rate to the loss before income taxes primarily

due to losses recorded in connection with the sale by Seagate Delaware of its operating assets located in the Far East that were not deductible

for U.S. tax purposes and the write-off of deferred tax assets that could not be recognized in the U.S. federal and state tax returns of our

predecessor for the taxable period ended November 22, 2000.

As of November 22, 2000, our predecessor’s foreign manufacturing subsidiaries had approximately $3.050 billion of undistributed

foreign earnings of which approximately $1.722 billion were considered permanently reinvested offshore. In connection with the sale of the

operating assets of Seagate Delaware, approximately $1.650 billion of the unremitted foreign earnings were deemed to be distributed for U.S.

tax purposes to the U.S. parent. Seagate Delaware had previously recorded deferred income tax liabilities of approximately $542 million for its

foreign earnings not considered permanently reinvested offshore. The deferred tax liabilities were eliminated because the remaining unremitted

earnings of our predecessor’s foreign subsidiaries will not be subject to U.S. corporate level tax if remitted to us.

Period from November 23, 2000 to June 29, 2001 . During this period, and particularly in the quarter ended June 29, 2001, our revenue

was negatively affected by an overall decline in demand for storage products due to reductions in global information technology spending

partially offset by the abatement of supply constraints with respect to certain electrical components. Our gross margins were positively

impacted by lower charges to cost of revenue for depreciation of approximately $140 million resulting from write-downs to fair value of our

depreciable assets in connection with the November 2000 transactions. Our gross margins were negatively impacted as a result of a $131

million write-up of inventories to fair value pursuant to purchase accounting rules and the subsequent sale of that inventory during the period.

At the time of the closing of the November 2000 transactions, we incurred marketing and administrative expenses of $40 million as a result of

management and advisory fees paid to selected members of our sponsor group and we recorded a $52 million charge to operations for in-

process research and development. We recorded additional restructuring charges of $66 million to continue the alignment of our global

workforce and manufacturing capacity with existing and anticipated future market requirements. In connection with the November 2000

transactions, our cash balances declined resulting in a lower level of interest income in this period and our predecessor repaid its long-

term debt

and we incurred new debt at higher interest rates resulting in a subsequently higher level of interest expense.

We recorded a $9 million provision for income taxes for the period from November 23, 2000 to June 29, 2001. The $9 million provision

for income taxes differs from the benefit from income taxes that would be derived by applying a notional U.S. 35% tax rate to the loss before

income taxes primarily due to the net effect of non-deductible charges related to the acquisition of the operating assets of Seagate Delaware, an

increase in our allowance for U.S. deferred tax assets of certain subsidiaries, and income generated from our manufacturing plants located in

China, Malaysia, Singapore and Thailand that operate under tax holidays (scheduled to expire in whole or in part at various dates through

2010).

34