Regions Bank 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Capital Requirements

Regions and Regions Bank are required to comply with the applicable capital adequacy standards

established by the Federal Reserve. There are two basic measures of capital adequacy for bank holding

companies that have been promulgated by the Federal Reserve: a risk-based measure and a leverage measure.

Risk-based Capital Standards. The risk-based capital standards are designed to make regulatory capital

requirements more sensitive to differences in credit and market risk profiles among banks and financial holding

companies, to account for off-balance sheet exposure, and to minimize disincentives for holding liquid assets.

Assets and off-balance sheet items are assigned to broad risk categories, each with appropriate weights. The

resulting capital ratios represent capital as a percentage of total risk-weighted assets and off-balance sheet items.

Currently the minimum guideline for the ratio of total capital (“Total capital”) to risk-weighted assets

(including certain off-balance sheet items, such as standby letters of credit) is 8.0 percent. The regulatory capital

rules state that voting common stockholders’ equity should be the predominant element within Tier 1 capital and

that banking organizations should avoid over-reliance on non-common equity elements. At least half of the Total

capital must be “Tier 1 capital,” which currently consists of qualifying common equity, qualifying noncumulative

perpetual preferred stock (including related surplus), senior perpetual preferred stock issued to the U.S. Treasury

as part of the Troubled Asset Relief Program Capital Purchase Program (the “CPP”), minority interests relating

to qualifying common or noncumulative perpetual preferred stock issued by a consolidated U.S. depository

institution or foreign bank subsidiary, and certain “restricted core capital elements,” as discussed below, less

goodwill and certain other intangible assets. Currently, “Tier 2 capital” may consist of, among other things,

qualifying subordinated debt, mandatorily convertible debt securities, preferred stock and trust preferred

securities not included in the definition of Tier 1 capital, and a limited amount of the allowance for loan losses.

Non-cumulative perpetual preferred stock, trust preferred securities and other so-called “restricted core capital

elements” are currently limited to 25 percent of Tier 1 capital. Pursuant to the Dodd-Frank Act, trust preferred

securities will be phased-out of the definition of Tier 1 capital of bank holding companies having consolidated

assets exceeding $500 million, such as Regions, over a three-year period beginning in January 2013.

Currently the minimum guideline to be considered well-capitalized for Tier 1 capital and Total capital is 6.0

percent and 10.0 percent, respectively. As of December 31, 2011, Regions’ consolidated Tier 1 capital to risk-

adjusted assets and Total capital to risk-adjusted assets ratios were 13.28 percent and 16.99 percent, respectively.

The elements currently comprising Tier 1 capital and Tier 2 capital and the minimum Tier 1 capital and Total

capital ratios may be subject to change in the future, as discussed in greater detail below. The risk-based capital

rules state that the capital requirements are minimum standards based primarily on broad credit-risk

considerations and do not take into account the other types of risk a banking organization may be exposed to

(e.g., interest rate, market, liquidity and operational risks).

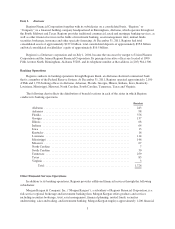

Basel I and II Standards. Regions currently calculates its risk-based capital ratios under guidelines

adopted by the Federal Reserve based on the 1988 Capital Accord (“Basel I”) of the Basel Committee on

Banking Supervision (the “Basel Committee”). In 2004, the Basel Committee published a new set of risk-based

capital standards (“Basel II”) to revise Basel I. Basel II provides two approaches for setting capital standards for

credit risk—an internal ratings-based approach tailored to individual institutions’ circumstances and a

standardized approach that bases risk-weighting on external credit assessments to a much greater extent than

permitted in the existing risk-based capital guidelines. Basel II also sets capital requirements for operational risk

and refines the existing capital requirements for market risk exposures.

A definitive final rule for implementing the advanced approaches of Basel II in the United States, which

applies only to internationally active banking organizations, or “core banks” (defined as those with consolidated

total assets of $250 billion or more or consolidated on-balance sheet foreign exposures of $10 billion or more)

became effective on April 1, 2008. Other U.S. banking organizations may elect to adopt the requirements of this

rule (if they meet applicable qualification requirements), but are not required to comply. The rule also allows a

10