Regions Bank 2011 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

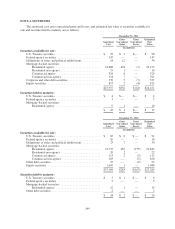

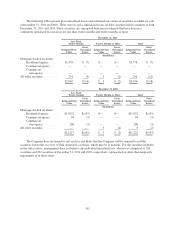

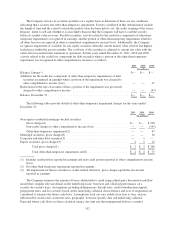

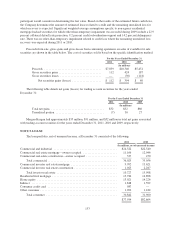

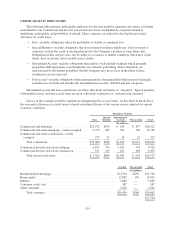

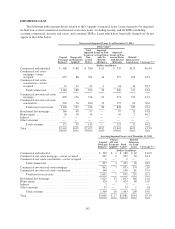

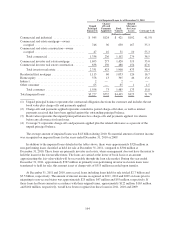

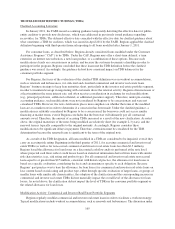

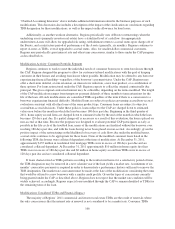

CREDIT QUALITY INDICATORS

The following tables present credit quality indicators for the loan portfolio segments and classes, excluding

loans held for sale. Commercial and investor real estate loan classes are detailed by categories related to

underlying credit quality and probability of default. These categories are utilized to develop the associated

allowance for credit losses.

• Pass—includes obligations where the probability of default is considered low;

• Special Mention—includes obligations that have potential weakness which may, if not reversed or

corrected, weaken the credit or inadequately protect the Company’s position at some future date.

Obligations in this category may also be subject to economic or market conditions which may, in the

future, have an adverse affect on debt service ability;

• Substandard Accrual—includes obligations that exhibit a well-defined weakness which presently

jeopardizes debt repayment, even though they are currently performing. These obligations are

characterized by the distinct possibility that the Company may incur a loss in the future if these

weaknesses are not corrected;

• Non-accrual—includes obligations where management has determined that full payment of principal

and interest is in doubt and includes the substandard non-accrual, doubtful and loss categories.

Substandard accrual and non-accrual loans are often collectively referred to as “classified.” Special mention,

substandard accrual, and non-accrual loans are often collectively referred to as “criticized and classified.”

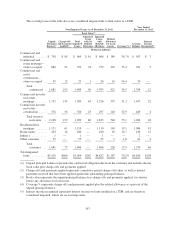

Classes in the consumer portfolio segment are disaggregated by accrual status. As described in detail above,

the associated allowance for credit losses is based on historical losses of the various classes adjusted for current

economic conditions.

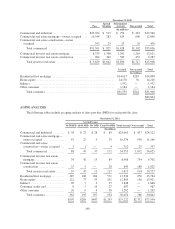

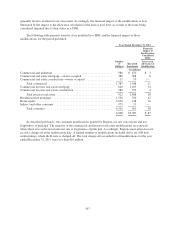

December 31, 2011

Pass

Special

Mention

Substandard

Accrual Non-accrual Total

(In millions)

Commercial and industrial ....................... $22,952 $479 $ 634 $ 457 $24,522

Commercial real estate mortgage—owner occupied . . . 9,773 262 541 590 11,166

Commercial real estate construction—owner

occupied ................................... 275 27 10 25 337

Total commercial .......................... $33,000 $768 $1,185 $1,072 $36,025

Commerical investor real estate mortgage ........... 6,851 756 1,361 734 9,702

Commercial investor real estate construction ......... 531 113 201 180 1,025

Total investor real estate ..................... $ 7,382 $869 $1,562 $ 914 $10,727

Accrual Non-accrual Total

(In millions)

Residential first mortgage .......................................... $13,534 $250 $13,784

Home equity ..................................................... 12,885 136 13,021

Indirect ......................................................... 1,848 — 1,848

Consumer credit card .............................................. 987 — 987

Other consumer .................................................. 1,202 — 1,202

Total consumer ............................................... $30,456 $386 $30,842

$77,594

159