Regions Bank 2011 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Risk Characteristics of the Loan Portfolio

In order to assess the risk characteristics of the loan portfolio, Regions considers the current U.S. economic

environment and that of its primary banking markets, as well as risk factors within the major categories of loans.

Economic Environment in Regions’ Banking Markets

One of the primary factors influencing the credit performance of Regions’ loan portfolio is the overall

economic environment in the U.S. and the primary markets in which it operates. The Great Recession that began

in December 2007 continued through 2008 and into 2009. Through this recessionary period, the overall output of

goods and services experienced its sharpest decline since the early 1980s. Consumer spending, about 70 percent

of all recorded spending, has been adversely impacted by declining inflation-adjusted income, low additional

credit capacity, historically high required monthly debt payments, a negative employment outlook, a higher

savings portion of after-tax personal income, and historically low consumer confidence. However, business

sector output continues to grow, driven by replenishment of inventories that were highly depleted during the

recession.

In 2009, the economic downturn that began with the housing slowdown continued to negatively impact

consumer confidence. In turn, lower confidence levels negatively affected demand for goods and services. This

lower demand impacted retail sales and led to increased vacancy rates and lower rent rolls for the commercial

real estate sector. High unemployment continued in 2009 but began improving in 2010 and 2011. Residential real

estate prices were stable in 2010, but declined again in 2011. Concerns remain about the impact on real estate

prices from the future sale of the large supply of homes that are either on bank balance sheets or have mortgages

that are currently delinquent.

Late in 2010, significant fiscal and monetary stimuli were implemented. The Federal Reserve approved the

purchase of an additional $600 billion in U.S. Treasury bonds, and the Congress approved significant tax

provisions that were expected to increase consumption, and, thereby, Gross Domestic Product (“GDP”). Even

with these measures, the 1.7 percent growth in real GDP in 2011 trailed the 3.0 percent growth rate in 2010, as

the U.S was negatively impacted by the ongoing credit crisis in the Eurozone. Overall, the consensus for 2012 is

for marginally better but still below-trend economic growth. While the unemployment rate in the U.S declined

from 9.4 percent in December 2010 to 8.5 percent in December 2011, the rate has been 8.5 percent or greater for

34 consecutive months.

Portfolio Characteristics

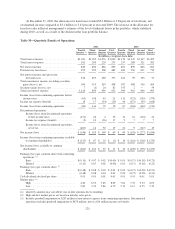

Regions has a diversified loan portfolio, in terms of product type, collateral and geography. At

December 31, 2011, commercial loans represented 46 percent of total loans, net of unearned income, investor

real estate loans represented 14 percent, residential first mortgage loans totaled 18 percent and other consumer

loans, largely home equity lending, comprised the remaining 22 percent. Following is a discussion of risk

characteristics of each loan type.

Commercial—The commercial loan portfolio segment totaled $36.0 billion at year-end 2011 and primarily

consists of loans to small and mid-sized commercial and large corporate customers with business operations in

Regions’ geographic footprint. Loans in this portfolio are generally underwritten individually and are usually

secured with the assets of the company and/or the personal guarantee of the business owners. Also considered as

commercial loans are owner-occupied commercial real estate loans to businesses for long-term financing of land

and buildings. Regions attempts to minimize risk on owner-occupied properties by requiring collateral values

that exceed the loan amount, adequate cash flow to service the debt, and, in many cases, the personal guarantees

of principals of the borrowers. Net charge-offs on commercial loans were 1.40 percent in 2011 compared to 1.86

percent in 2010.

115