Regions Bank 2011 Annual Report Download - page 168

Download and view the complete annual report

Please find page 168 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In June 2009, the FASB issued accounting guidance modifying how a company determines when a VIE

should be consolidated. It also requires a qualitative assessment of an entity’s determination of the primary

beneficiary of a VIE based on whether the entity 1) has the power to direct the activities of a VIE that most

significantly impact the entity’s economic performance, and 2) has the obligation to absorb losses of the entity

that could potentially be significant to the VIE or the right to receive benefits from the entity that could

potentially be significant to the VIE. An ongoing reassessment is also required to determine whether a company

is the primary beneficiary of a VIE as well as additional disclosures about a company’s involvement in VIEs.

This guidance is effective for fiscal years beginning after November 15, 2009 and its adoption did not have a

material impact to the consolidated financial statements.

In August 2009, the FASB issued updated guidance to further guidance on how to measure the fair value of

a liability and is effective for the first reporting period beginning after August 26, 2009. The adoption of this

guidance did not have a material impact to the consolidated financial statements.

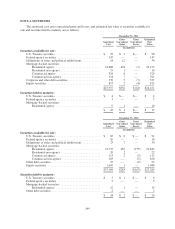

In January 2010, the FASB issued accounting guidance regarding disclosures of fair value measurements.

The guidance requires additional disclosures related to the transfers in and out of fair value hierarchy and the

activity of Level 3 financial instruments. The guidance also provides clarification for the classification of

financial instruments and the discussion of inputs and valuation techniques. The new disclosures and clarification

are effective for interim and annual reporting periods beginning after December 15, 2009, except for the

disclosures related to the activity of Level 3 financial instruments. Those disclosures are effective for periods

beginning after December 15, 2010 and for interim periods within those years. All provisions of the guidance

were adopted by Regions during the first quarter of 2010. See the “Fair Value Measurements” section above and

Note 21 for additional information regarding fair value measurements.

In February 2010, the FASB issued updated guidance which defers, for certain investment funds, the

consolidation requirements as a result of updated consolidation guidance. Specifically, the deferral is applicable

for a reporting entity’s interest in an entity (1) that has all the attributes of an investment company or (2) for

which it is industry practice to apply measurement principles for financial reporting purposes that are consistent

with those followed by investment companies. This guidance is effective for periods beginning after

November 15, 2009. Regions adopted its provisions during the first quarter of 2010. The adoption of this

guidance did not have a material impact to the consolidated financial statements.

In March 2010, the FASB issued accounting guidance relating to the scope exception related to embedded

credit derivatives amending and clarifying the accounting for credit derivatives embedded in interests in

securitized financial assets. This guidance is effective for interim periods beginning after June 15, 2010 and its

adoption did not have a material impact to the consolidated financial statements.

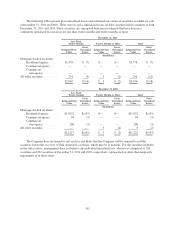

In July 2010, the FASB issued accounting guidance related to disclosures about the credit quality of

financing receivables and the allowance for credit losses. The amended guidance applies to all financing

receivables except for short-term trade receivables and receivables measured at either fair value or the lower of

cost or fair value. The objective of the amendment is disclosure of information that enables financial statement

users to understand the nature of inherent credit risks, the entity’s method of analysis and assessment of credit

risk in estimating the allowance for credit losses, and the reasons for changes in both the receivables and

allowances when examining a creditor’s portfolio of financing receivables and its allowance for losses. Under the

new guidance, the disaggregation of financing receivables will be disclosed by portfolio segment or by class of

financing receivable. The amended guidance is applicable to period-end balances beginning with the first interim

or annual reporting period ending on or after December 15, 2010. Regions adopted this guidance as of

December 31, 2010 for the disclosures related to end of period financial reporting. See Note 6 for additional

information regarding the allowance for credit losses.

In December 2010, the FASB issued guidance for the consideration an entity must give regarding whether it

is more likely than not that goodwill impairment exists for each reporting unit with a zero or negative carrying

144