Regions Bank 2011 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

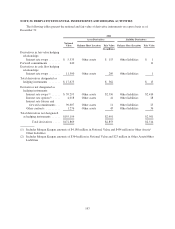

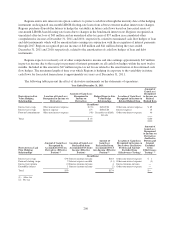

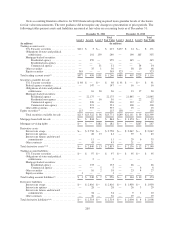

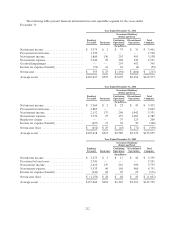

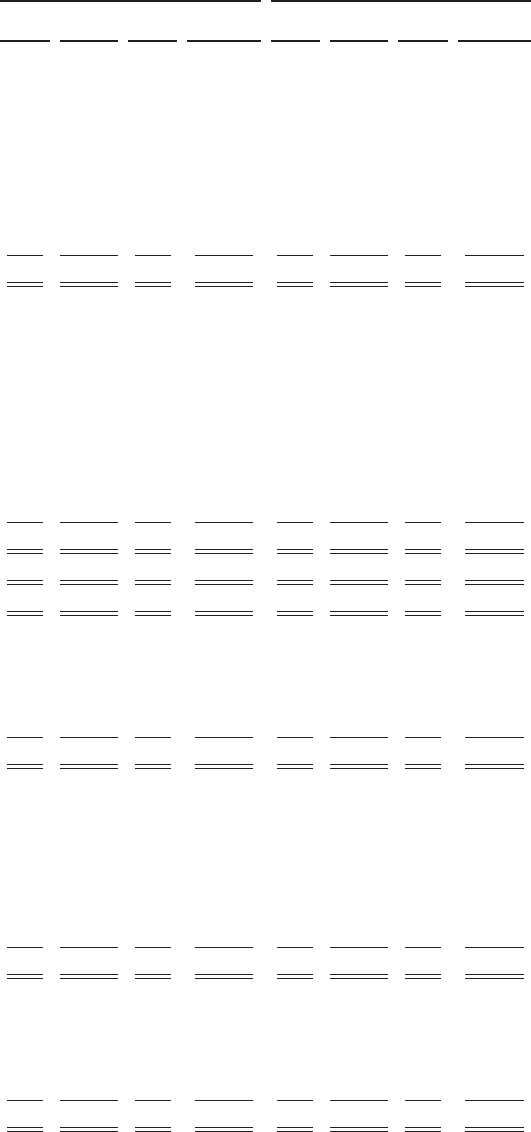

New accounting literature effective for 2010 financial reporting required more granular levels of disclosure

for fair value measurements. The new guidance did not require any changes to presentation of prior periods. The

following tables present assets and liabilities measured at fair value on a recurring basis as of December 31:

December 31, 2011 December 31, 2010

Level 1 Level 2 Level 3

Total

Fair Value Level 1 Level 2 Level 3

Total

Fair Value

(In millions) (In millions)

Trading account assets .......................

U.S. Treasury securities .................. $212 $ 3 $— $ 215 $157 $ 14 $— $ 171

Obligations of states and political

subdivisions ......................... — 101 139 240 — 190 165 355

Mortgage-backed securities:

Residential agency .................. — 359 — 359 — 145 — 145

Residential non-agency .............. — — — — — — — —

Commercial agency ................. — — 51 51 — — 54 54

Other securities ........................ — 35 1 36 — 58 10 68

Equity securities ....................... 365 — — 365 323 — — 323

Total trading account assets(1) ................. $577 $ 498 $191 $ 1,266 $480 $ 407 $229 $ 1,116

Securities available for sale ...................

U.S. Treasury securities .................. $ 98 $ — $— $ 98 $ 91 $ — $— $ 91

Federal agency securities ................. — 147 — 147 — 16 — 16

Obligations of states and political

subdivisions ......................... — 16 20 36 — 13 17 30

Mortgage-backed securities:

Residential agency .................. — 22,175 — 22,175 — 21,845 — 21,845

Residential non-agency .............. — — 16 16 — — 22 22

Commercial agency ................. — 326 — 326 — 112 — 112

Commercial non-agency ............. — 321 — 321 — 100 — 100

Other debt securities .................... — 537 — 537 — 25 — 25

Equity securities(2) .......................... 115 — — 115 158 — — 158

Total securities available for sale .......... $213 $23,522 $ 36 $23,771 $249 $22,111 $ 39 $22,399

Mortgage loans held for sale .................. $— $ 844 $— $ 844 $— $ 1,174 $— $ 1,174

Mortgage servicing rights .................... $— $ — $182 $ 182 $— $ — $267 $ 267

Derivative assets

Interest rate swaps ...................... $— $ 2,758 $— $ 2,758 $— $ 2,047 $— $ 2,047

Interest rate options ..................... — 28 13 41 — 39 6 45

Interest rate futures and forward

commitments ........................ — 11 — 11 — 29 6 35

Other contracts ........................ — 43 — 43 — 21 — 21

Total derivative assets(3)(4) .................... $— $ 2,840 $ 13 $ 2,853 $— $ 2,136 $ 12 $ 2,148

Trading account liabilities ....................

U.S. Treasury securities .................. $— $ 97 $— $ 97 $— $ 95 $— $ 95

Obligations of states and political

subdivisions ......................... — 2 — 2 — — — —

Mortgage-backed securities:

Residential agency .................. — 133 — 133 — 46 — 46

Commercial agency ................. — — 5 5 — — 6 6

Other securities ........................ — 16 2 18 — 23 4 27

Equity securities ....................... 1 — — 1 — — — —

Total trading account liabilities(5) .............. $ 1 $ 248 $ 7 $ 256 $— $ 164 $ 10 $ 174

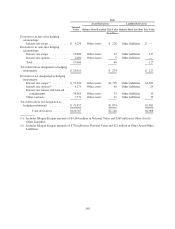

Derivative liabilities ........................

Interest rate swaps ...................... $— $ 2,416 $— $ 2,416 $— $ 1,950 $— $ 1,950

Interest rate options ..................... — 28 — 28 — 26 3 29

Interest rate futures and forward

commitments ........................ — 34 — 34 — 9 1 10

Other contracts ........................ — 36 — 36 — 19 — 19

Total derivative liabilities(3)(4) ................. $— $ 2,514 $— $ 2,514 $— $ 2,004 $ 4 $ 2,008

205