Regions Bank 2011 Annual Report Download - page 138

Download and view the complete annual report

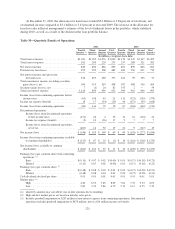

Please find page 138 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.At December 31, 2011, Regions’ international exposure was approximately $500 million in total. Amounts

in excess of 75 percent of the exposure relate to highly-rated Western European entities.

Regions’ Counterparty Risk department is responsible for the setting of country limits and managing of the

outstanding country exposure for all departments of the bank as well as monitoring compliance of the

outstanding exposure to the set limits. Reports are sent to Counterparty Risk by the lines of business on a

monthly basis to demonstrate their compliance with their set limits. Counterparty Risk conducts a formal,

quarterly assessment of the exposure, on both an outstanding and limit basis, which is then distributed to upper

management for review.

CREDIT RISK

Regions’ objective regarding credit risk is to maintain a high-quality credit portfolio that provides for stable

credit costs with acceptable volatility through an economic cycle. See the “Credit Quality” section found earlier

in this report for further information.

Management Process

Regions employs a credit risk management process with defined policies, accountability and regular

reporting to manage credit risk in the loan portfolio. Credit risk management is guided by credit policies that

provide for a consistent and prudent approach to underwriting and approvals of credits. Within the Credit Policy

department, procedures exist that elevate the approval requirements as credits become larger and more complex.

Generally, consumer credits and smaller commercial credits are centrally underwritten based on custom credit

matrices and policies that are modified as appropriate. Larger commercial and investor real estate transactions are

individually underwritten, risk-rated, approved and monitored.

Responsibility and accountability for adherence to underwriting policies and accurate risk ratings lies in the

lines of business. For consumer and small business portfolios, the risk management process focuses on managing

customers who become delinquent in their payments and managing performance of the credit scorecards, which

are periodically adjusted based on actual credit performance. Commercial business units are responsible for

underwriting new business and, on an ongoing basis, monitoring the credit of their portfolios, including a

complete review of the borrower semi-annually or more frequently as needed.

To ensure problem commercial credits are identified on a timely basis, several specific portfolio reviews

occur each quarter to assess the larger adversely rated credits for accrual status and, if necessary, to ensure such

individual credits are transferred to Regions’ Problem Asset Management Division, which specializes in

managing distressed credit exposures.

There are also separate and independent commercial credit and consumer credit risk management

organizational groups. These organizational units partner with the business line to assist in the processes

described above, including the review and approval of new business and ongoing assessments of existing loans in

the portfolio. Independent commercial and consumer credit risk management provides for more accurate risk

ratings and the timely identification of problem credits, as well as oversight for the Chief Credit Officer on

conditions and trends in the credit portfolios.

Credit quality and trends in the loan portfolio are measured and monitored regularly and detailed reports, by

product, business unit and geography, are reviewed by line of business personnel and the Chief Credit Officer.

The Chief Credit Officer reviews summaries of these credit reports with executive management and the Board of

Directors. Finally, the Credit Review department provides ongoing independent oversight of the credit portfolios

to ensure policies are followed, credits are properly risk-rated and that key credit control processes are

functioning as intended.

114