Regions Bank 2011 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2011 Regions Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268

|

|

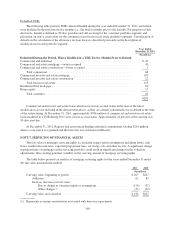

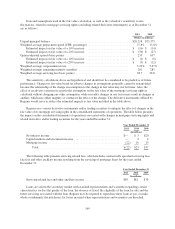

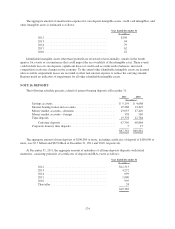

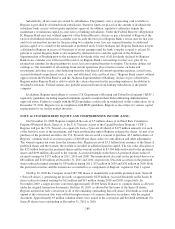

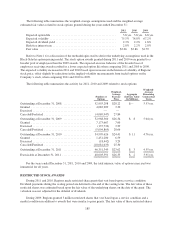

NOTE 11. SHORT-TERM BORROWINGS

Following is a summary of short-term borrowings at December 31:

2011 2010

(In millions)

Company funding sources:

Federal funds purchased .................................. $ 18 $ 19

Securities sold under agreements to repurchase ................ 969 763

Federal Home Loan Bank advances ......................... — 500

Treasury, tax and loan notes ............................... — 118

Other short-term borrowings ............................... 29 95

1,016 1,495

Customer-related borrowings:

Securities sold under agreements to repurchase ................ 1,346 1,934

Brokerage customer liabilities .............................. 394 324

Short-sale liability ....................................... 256 174

Customer collateral ...................................... 55 10

2,051 2,442

$3,067 $3,937

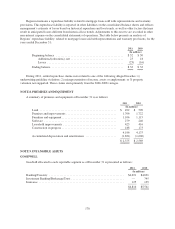

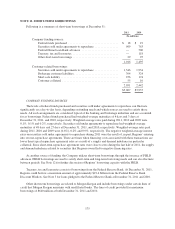

COMPANY FUNDING SOURCES

The levels of federal funds purchased and securities sold under agreements to repurchase can fluctuate

significantly on a day-to-day basis, depending on funding needs and which sources are used to satisfy those

needs. All such arrangements are considered typical of the banking and brokerage industries and are accounted

for as borrowings. Federal funds purchased had weighted-average maturities of 4 days and 3 days at

December 31, 2011, and 2010, respectively. Weighted-average rates paid during 2011, 2010 and 2009 were

0.1%, 0.1% and 0.2%, respectively. Securities sold under agreements to repurchase had weighted-average

maturities of 48 days and 27 days at December 31, 2011, and 2010, respectively. Weighted-average rates paid

during 2011, 2010 and 2009 were (0.6%), 0.2% and 0.9%, respectively. The negative weighted-average interest

rates on securities sold under agreements to repurchase during 2011 were the result of, in part, Regions’ entering

into reverse-repurchase agreements. There are times when financing costs associated with these transactions are

lower than typical repurchase agreement rates as a result of a supply and demand imbalance in particular

collateral. Since short-term repurchase agreement rates were close to zero during the last half of 2011, the supply

and demand imbalance related to securities that Regions owned led to negative financing rates.

As another source of funding, the Company utilizes short-term borrowings through the issuance of FHLB

advances. FHLB borrowings are used to satisfy short-term and long-term borrowing needs and can also fluctuate

between periods. See Note 12 for further discussion of Regions’ borrowing capacity with the FHLB.

Treasury, tax and loan notes consist of borrowings from the Federal Reserve Bank. At December 31, 2011,

Regions could borrow a maximum amount of approximately $19.4 billion from the Federal Reserve Bank

Discount Window. See Note 5 for loans pledged to the Federal Reserve Bank at December 31, 2011 and 2010.

Other short-term borrowings are related to Morgan Keegan and include borrowings under certain lines of

credit that Morgan Keegan maintains with unaffiliated banks. The lines of credit provided for maximum

borrowings of $640 million at both December 31, 2011 and 2010.

175