Redbox 2005 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2005, 2004, AND 2003

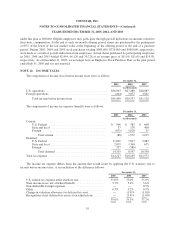

Currently, management does not use product line financial performance as a basis for business operating

decisions. However, our CEO does analyze our revenue based on revenue generated from our coin-counting and

e-payment service revenue separate from revenue generated from our entertainment services business. Revenue

for these two product lines is as follows:

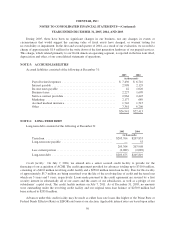

Year ended December 31,

2005 2004 2003

(in thousands)

Revenue:

Coin-counting and e-payment services ........................... $220,675 $196,026 $176,136

Entertainment services ........................................ 239,064 111,074 —

Total revenue ........................................... $459,739 $307,100 $176,136

We have coin-counting, entertainment and e-payment services machines that are placed with retailers that

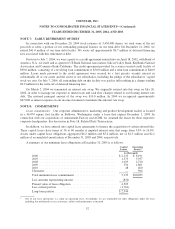

accounted for the following percentages of our consolidated revenue:

Year ended December 31,

2005 2004 2003

Wal-Mart, Inc. ............................................................ 25.3% 20.9% 3.4%

The Kroger Company ...................................................... 10.5% 14.7% 22.3%

Albertson’s, Inc. ........................................................... 7.3% 9.1% 11.8%

NOTE 17: CERTAIN SIGNIFICANT RISKS AND UNCERTAINTIES

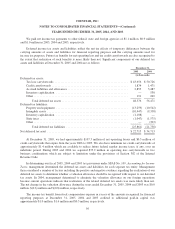

Current Vulnerability Due to Supplier Concentrations:

Substantially all of the plush toys and other products dispensed from the entertainment services machines

are produced by foreign manufacturers. A majority of these purchases are made directly from manufacturers in

China. We purchase our other products indirectly from vendors who obtain a significant percentage of such

products from foreign manufacturers. As a result, we are subject to changes in governmental policies, the

imposition of tariffs, import and export controls, transportation delays and interruptions, political and economic

disruptions and labor strikes, which could disrupt the supply of products from such manufacturers and could

result in substantially increased costs for certain products purchased by us which could have a material adverse

effect on our financial performance.

We currently conduct limited manufacturing operations and obtain key hardware components used in our

coin-counting and entertainment services machines from a limited number of suppliers. Although we use a

limited number of suppliers, we believe that other suppliers could provide similar equipment, which may require

certain modifications or may have a longer lead time from order date. Accordingly, a change in suppliers could

cause a delay in manufacturing and a possible slow-down of growth, which could have a materially adverse

affect on future operating results.

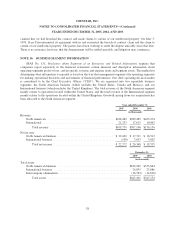

NOTE 18: RELATED PARTY TRANSACTIONS

Randall J. Fagundo, President of our entertainment services subsidiaries, is a member of a limited liability

company which has agreed to lease to Coinstar a 31,000 square foot building located in Louisville, Colorado.

The terms of the agreement provide for a ten year lease term, commencing March 1, 2003, at monthly rental

59