Redbox 2005 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.and (3) field operations support and related expenses. Variations in the percentage of transaction fees we

pay to our retail partners may result in increased expenses. Such variations are based on our evaluation of

certain factors with the retailer, such as total revenue, e-payment capabilities, long-term non-cancelable

contracts, installation of our machines in high traffic and/or urban or rural locations, new product

commitments, or other criteria.

For entertainment services, these expenses consist primarily of (1) the fees we pay our retail partners as

commissions and for the placement of machines, (2) the cost of plush toys and other products dispensed

from the skill-crane and bulk-vending machines and (3) field operations support and related expenses.

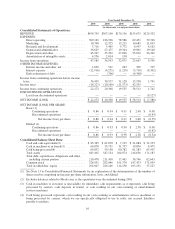

Direct operating expenses increased to $309.2 million during the year ended December 31, 2005 from

$186.9 million during 2004 and $78.6 million during 2003. Direct operating expenses increased primarily due to

expenses incurred to support our increased year over year revenues and the acquisitions of our entertainment

businesses. The addition of our entertainment companies to our 4th Wall products and services offerings has

added inventory and related freight cost to our direct operating expenses, which we do not incur operating our

coin-counting services. Direct operating expenses as a percentage of revenue increased year over year to 67.2%

during 2005, from 60.9% during 2004 and 44.6% during 2003, mainly from the addition of our entertainment

subsidiaries which represented about 52% of our total revenue during 2005. This increase is mainly due to our

entertainment business which has higher ongoing direct operating costs as a percentage of revenue than our coin

business. We are in the process of integrating our various business operations and expect to realize some

operating expense efficiencies as a percentage of revenue during 2006.

Marketing

Our marketing expenses consist primarily of marketing, advertising and public relations efforts in existing

market regions and startup marketing expenses incurred to launch our services in new regional markets.

Marketing expenses decreased to $10.7 million during the year ended December 31, 2005 from $12.9

million during 2004 and $13.2 million during 2003. We have been directing most of our advertising dollars

toward regional broadcasting and promotions as we introduce e-payment features on our coin-counting machines

and other e-payment product channels like our gift card mall offerings. Our regional introduction of e-payment

products enables us to use cost effective regional marketing strategies rather than more expensive national

marketing campaigns. This directed marketing and advertising approach continues driving increased trial and

repeat usage of both our coin services offering and e-payment products. Since our revenues have significantly

increased primarily due to our acquisition of ACMI in 2004, and our marketing expenditures have decreased,

marketing as a percentage of revenue decreased to 2.3% from 4.2% during 2004 and 7.5% during 2003.

Research and Development

Our research and development expenses consist primarily of development costs of our coin-counting

machine software, network applications, machine improvements and new product development.

Research and development expenses have remained relatively consistent. Our research and development

expenses were $5.7 million during the year ended December 31, 2005, $5.5 million during 2004 and $5.8 million

during 2003. Research and development expenses represent expenditures to support development and design of

complementary new product ideas and continue our ongoing efforts to enhance our existing products and

services, primarily our coin-counting system. It is our intent to continue to invest in research and development in

the coming years. Over the last two years we have also acquired some technology related to our entertainment

business. We have capitalized these costs as intangible assets. Since revenues have increased significantly and

our research and development expenditures remained relatively consistent, research and development as a

percentage of revenue has been decreasing to 1.2% during 2005 from 1.8% during 2004 and 3.3% during 2003.

22