Redbox 2005 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2005, 2004, AND 2003

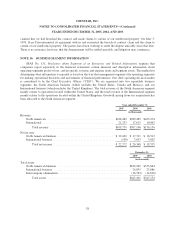

During 2005, there have been no significant changes in our business, nor any changes in events or

circumstances that would suggest the carrying value of fixed assets have changed, or warrant testing for

recoverability or impairment. In the first and second quarter of 2004, as a result of our evaluation, we recorded a

charge of approximately $1.9 million for the write down of the first generation hardware of our prepaid services.

This charge, which related primarily to our North American operating segment, is reported in the line item titled,

depreciation and other, of our consolidated statements of operations.

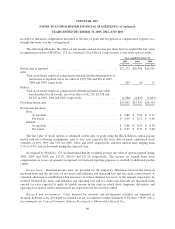

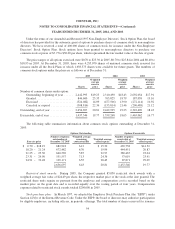

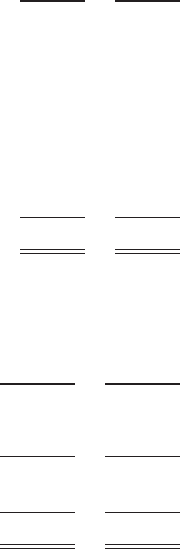

NOTE 5: ACCRUED LIABILITIES

Accrued liabilities consisted of the following at December 31:

2005 2004

(in thousands)

Payroll related expenses .................................... $ 7,430 $ 6,716

Interest payable ........................................... 2,998 2,129

Income taxes payable ...................................... 42 1,020

Business taxes ............................................ 2,227 1,699

Service contract providers ................................... 2,964 2,445

Marketing ............................................... 2,177 689

Accrued medical insurance .................................. 1,742 1,515

Other ................................................... 7,361 6,200

$26,941 $22,413

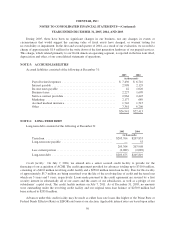

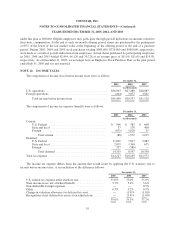

NOTE 6: LONG-TERM DEBT

Long-term debt consisted of the following at December 31:

2005 2004

(in thousands)

Term loan ............................................. $205,764 $207,853

Long-term note payable .................................. — 55

205,764 207,908

Less current portion ...................................... (2,089) (2,089)

Long-term debt ......................................... $203,675 $205,819

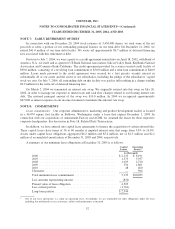

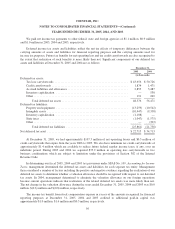

Credit facility: On July 7, 2004, we entered into a senior secured credit facility to provide for the

financing of our acquisition of ACMI. The credit agreement provided for advances totaling up to $310.0 million,

consisting of a $60.0 million revolving credit facility and a $250.0 million term loan facility. Fees for this facility

of approximately $5.7 million are being amortized over the life of the revolving line of credit and the term loan

which are 5 years and 7 years, respectively. Loans made pursuant to the credit agreement are secured by a first

security interest in substantially all of our assets and the assets of our subsidiaries, as well as a pledge of our

subsidiaries’ capital stock. The credit facility matures on July 7, 2011. As of December 31, 2005, no amounts

were outstanding under the revolving credit facility and our original term loan balance of $250.0 million had

been reduced to $205.8 million.

Advances under this credit facility may be made as either base rate loans (the higher of the Prime Rate or

Federal Funds Effective Rate) or LIBOR rate loans at our election. Applicable interest rates are based upon either

50