Redbox 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2005, 2004, AND 2003

its carrying amount including goodwill. If the fair value of a reporting unit exceeds its carrying amount, goodwill

of the reporting unit is considered not impaired and the second test is not performed. The second step of the

impairment test is performed when required and compares the implied fair value of the reporting unit goodwill

with the carrying amount of that goodwill. If the carrying amount of the reporting unit goodwill exceeds the

implied fair value of that goodwill, an impairment loss shall be recognized in an amount equal to that excess.

Based on the annual goodwill test for impairment we performed during the quarter ended December 31, 2005, we

determined there is no impairment of our goodwill. Goodwill consisted of approximately $136.1 and $134.2

million related to the acquisition of American Coin Merchandising, Inc. (collectively referred to as “ACMI”),

$23.2 and $0.0 million related to the acquisition of The Amusement Factory L.L.C. (“Amusement Factory”) and

$20.2 and $6.1 million resulting from other acquisitions at December 31, 2005 and 2004, respectively.

Our intangible assets are comprised primarily of retailer relationships acquired in connection with our

acquisition of ACMI in 2004, Amusement Factory in 2005 and other smaller acquisitions during 2004 and 2005.

A third-party consultant used expectations of future cash flows to estimate the fair value of the acquired retailer

relationships. We amortize our intangible assets on a straight-line basis over their expected useful lives, which

range from 3 to 10 years.

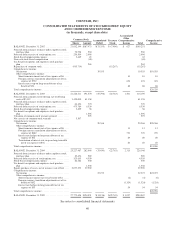

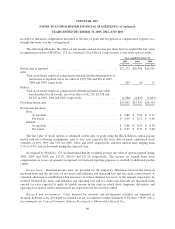

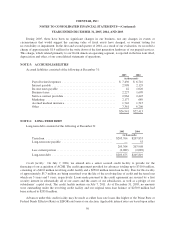

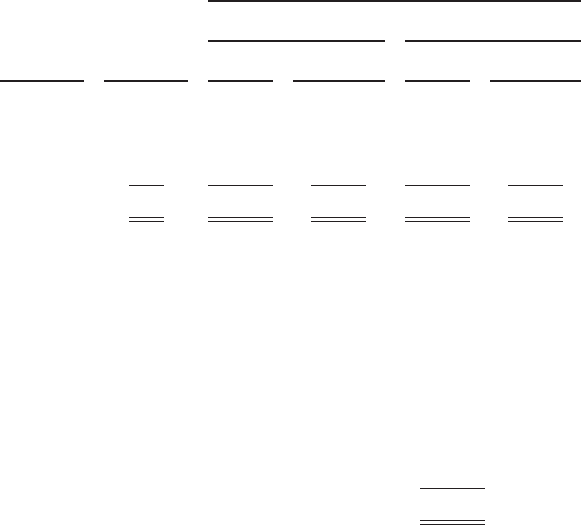

The gross carrying amounts and related accumulated amortization as well as the range of estimated useful

lives of identifiable intangible assets at the reported balance sheet dates were as follows:

Range of

Estimated

Useful Lives

(in years)

Estimated

Weighted

Average

Useful Lives

(in years)

December 31,

(in thousands)

2005 2004

Gross

Amount

Accumulated

Amortization

Gross

Amount

Accumulated

Amortization

Intangible assets:

Retailer relationships .......... 3-10 9.25 $45,446 $6,099 $36,229 $1,831

Other identifiable intangible

assets .................... 3-5 0.14 1,401 609 956 321

Total .......................... 9.39 $46,847 $6,708 $37,185 $2,152

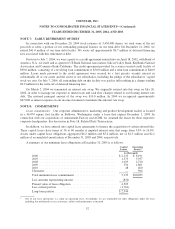

Based on identifiable intangible assets recorded as of December 31, 2005, and assuming no subsequent

impairment of the underlying assets, the annual estimated aggregate future amortization expenses are as follows:

(in thousands)

2006 .......................................................... $ 5,311

2007 .......................................................... 5,279

2008 .......................................................... 5,019

2009 .......................................................... 4,800

2010 .......................................................... 4,298

Thereafter ...................................................... 15,432

$40,139

Impairment of long-lived assets: Long-lived assets, such as property and equipment and purchased

intangibles subject to amortization, are reviewed for impairment whenever events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. Recoverability of assets to be held and used

44