Redbox 2005 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2005 Redbox annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

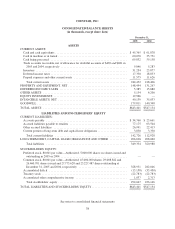

COINSTAR, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

YEARS ENDED DECEMBER 31, 2005, 2004, AND 2003

Trade accounts receivable: Trade accounts receivable represents trade receivables, net of allowances for

doubtful accounts. The allowance for doubtful accounts reflects our best estimate of probable losses inherent in

the accounts receivable balance. We determine the allowance based on known troubled accounts, historical

experience and other currently available evidence. When a specific account is deemed uncollectible, the account

is written off against the allowance. In 2005, the amount expensed for uncollectible accounts was approximately

$230,000 and the amount charged against the allowance was $220,000. In 2004, the amount expensed for

uncollectible accounts was approximately $65,000 and the amount charged against the allowance was $120,000.

Inventory: Inventory, which consists primarily of plush toys and other products dispensed from our

entertainment services machines, is stated at the lower of cost or market. The cost of inventory includes mainly

the cost of materials, and to a lesser extent, labor, overhead and freight. Cost is determined using the average cost

method. Inventory, which is considered finished goods, consists of purchased items ready for resale or use in

vending operations.

Property and equipment: Property and equipment are stated at cost, net of accumulated depreciation.

Expenditures that extend the life, increase the capacity, or improve the efficiency of property and equipment are

capitalized, while expenditures for repairs and maintenance are expensed as incurred. Depreciation is recognized

using the straight-line method over the following approximate useful lives.

Useful Life

Coin-counting and e-payment machines .............................. 5years

Entertainment services machines .................................... 10years

Vending machines ............................................... 3to5years

Computers ...................................................... 3years

Office furniture and equipment ..................................... 5years

Leased vehicles .................................................. 3years

Leasehold improvements .......................................... 5to7years

Equity investments: We are accounting for our minority ownership of our investments under the equity

method in our consolidated financial statements, of which we received dividends from one of our investments

during 2005. During 2005, we invested $20.0 million to obtain a 47.3% interest in Redbox. Consumers can rent

DVD movies through Redbox self service kiosks for about $1 per day. Our 47.3% interest in this investment

includes a conditional consideration agreement to contribute an additional $12.0 million if Redbox achieves

certain targets within a one year period. Under certain conditions, based on the terms of the agreement, we may

be able to obtain a majority interest in this agreement.

Purchase price allocations: In connection with our acquisitions of our entertainment and e-payment

subsidiaries, we have allocated the respective purchase prices plus transaction costs to the estimated fair values

of assets acquired and liabilities assumed. These purchase price allocation estimates were based on our estimates

of fair values and estimates from third-party consultants. Adjustments to our purchase price allocation estimates

are made based on our final analysis of the fair value during the allocation period, which is within one year of the

purchase date.

Goodwill and intangible assets: Goodwill represents the excess of cost over the estimated fair value of net

assets acquired which is not being amortized. We test goodwill for impairment at the reporting unit level on an

annual or more frequent basis as determined necessary. SFAS No. 142 requires a two-step goodwill impairment

test whereby the first step, used to identify potential impairment, compares the fair value of a reporting unit with

43